Download PDF:

As a rising growth star in the Emerging Market universe and South East Asia region, both Indonesia and Philippines share many similarities. First, both countries run fiscal and current account deficit. Second, both have a government that are currently focusing on building the country’s capital through multi-year infrastructure projects. Third, they have a similar macro profile, as proxied by its public debt level, external financing requirement, reserves adequacy, history of high inflationary pressure and dependence on its currency to correct the domestic imbalances. Lastly, the two countries have a large young population and rising middle class segment, which allow their economy to grow above 5% rate in the past decade.

Despite all the similarities, however, the two countries’ assets performance have diverged significantly this year amid the COVID-19 crisis. Indonesia’s rupiah has sold off dramatically before staging an equally rapid rebound, while Philippines’ Peso has been very resilient and continued to strengthen despite the hit to its domestic economy. Indonesian bond yield also experienced a spike during the rout, contrary to Philippines’ bond that is trading at a historic low yield.

There are several points worth noting when comparing the two countries asset market and country profile, outlined below:

Fiscal. For the past few years, Philippines and Indonesian government have been pushing for large infrastructure projects involving multi-year investment horizon, as an effort to improve the country’s transportation network and developing its human capital. The two countries’ government currently spend 2.5% of GDP in infrastructure spending, a significant jump from 1.5% of GDP in 2014, and is set to increase further in the coming years (Chart 1). To finance the increase in spending, Philippines have been running a wider fiscal deficit, whereas Indonesian government opted to shifting its subsidy spending toward more productive expenditure.

It is no doubt that both Indonesia and Philippines have been hit hard by the COVID-19 pandemic, as poor health care system and almost negligible contact-tracing ability allow the virus to spread uncontrolled. Moreover, the large portion of informal workers in both economy and the associated cost of stringent lockdown has led to a half-hearted lockdown imposed by the government, which succeed in neither preventing the virus to spread nor protecting the economy from a selective lockdown policy. As a part of COVID-19 response, Philippines government launched a rather small, 3.1% of GDP fiscal package while Indonesian government has so far announced two rounds of stimulus worth 7.1% of GDP in total. The size of both government stimulus relates to the fact that Philippines’ government has been running a larger fiscal deficit since Duterte’s presidency and has a larger public debt level compared to Indonesian government (Chart 2). Relative size of the fiscal stimulus point to a likely stronger growth of the Indonesian economy relative to Philippines going forward, which should lead to underperformance of Philippines’ asset prices.

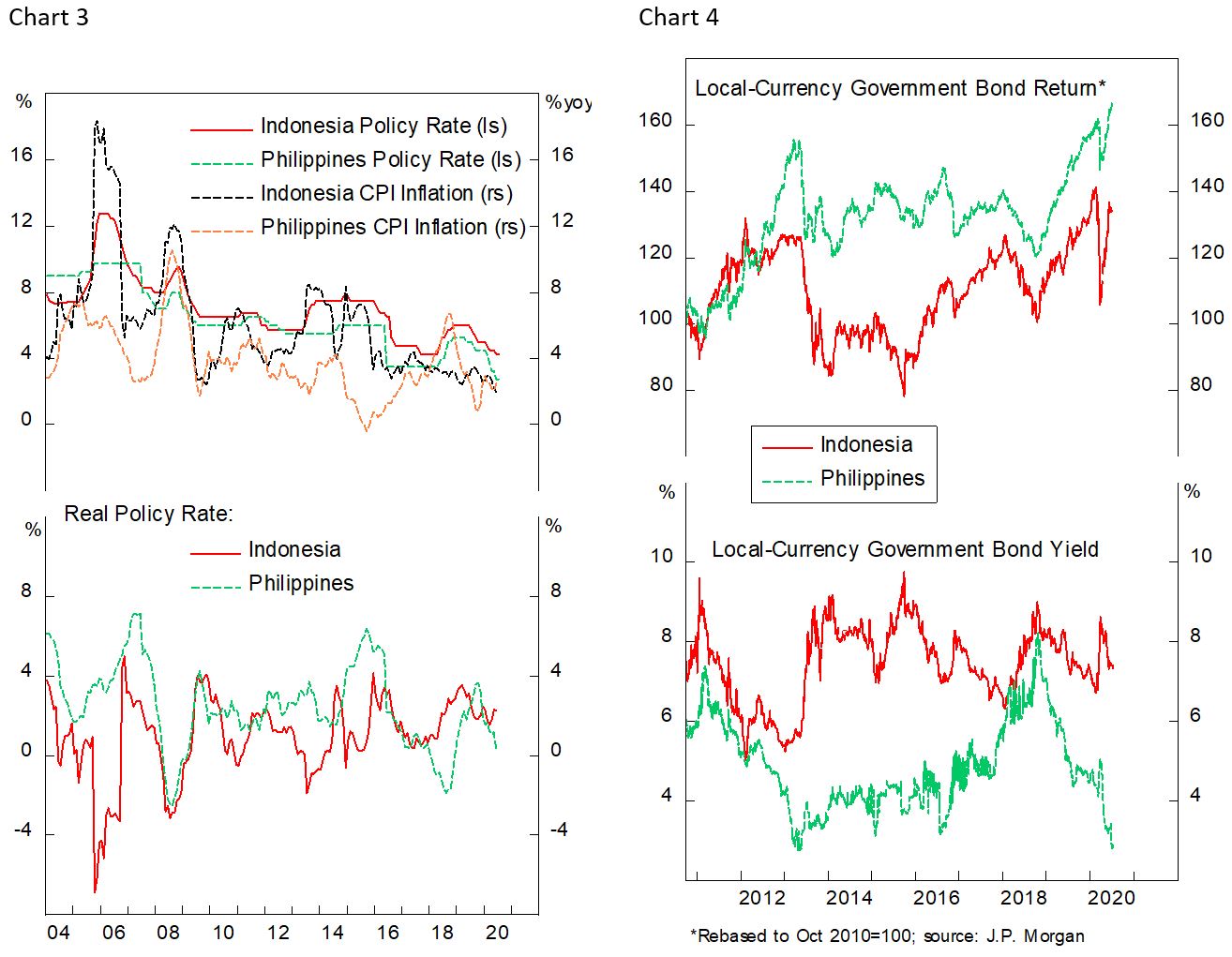

Monetary. From a monetary policy perspective, Philippines central bank has been far more aggressive in easing its policy rate, cutting 175 bps since the beginning of the year compared to 75 bps cut by the Indonesian central bank. Although inflation melted in both countries, the front-loading of monetary easing has resulted in real policy rate dropping to 0.2% in Philippines, compared to 2.3% for Indonesia, highlighting the limited room to ease further in the former (Chart 3). At the same time, Philippines local-currency bond yield decline dramatically from 4.5% in the beginning of the year to 2.8% currently, easing the domestic financial condition considerably. Indonesian government bond yield, however, has been largely flat at 7.3% since the beginning of the year (Chart 4). This is puzzling to us, given Philippines relatively weaker fiscal and public debt position compared to Indonesia, which should translate to its government bond trading at a higher yield. Moreover, at a real yield below 0.3%, Philippines bond is not attractive for global investors. The risk/return profile is much better for Indonesian government bond, with a real yield of 5.4% (Chart 5).

The Philippine Peso’s strength amid its twin deficit status is also stoking skepticism among us. The currency has strengthened against the dollar and other EM currencies, being very resilient despite the backdrop of a deteriorating economy. There are three reasons why we think the currency is expensive and going to underperform relative to the rupiah. First, rupiah has corrected significantly this year and is still undervalued based on the differences between the two countries’ CPI and PPI (Chart 6). Second, our fair-value estimate, based on terms of trade, balance of payment and productivity, shows that real effective PHP is one of the most expensive currency in EM universe (Chart 7). Third, relative terms of trade of the two countries seem to have bottom alongside with commodity prices, which will likely benefit Rupiah at the expense of PHP going forward as commodity prices strengthen (Chart 8).

The Economy and Trade. As a high savings and a high investment country, both Indonesia and Philippines run a current account deficit in the past few years, a trend which has been reversing even before the pandemic began. Philippines economy is hugely dependent on remittances income from its overseas workers, worth some 8% of its GDP (Chart 9). The COVID-19 pandemic has likely hurt Philippines working abroad as a sailor and domestic worker, as global trade was halted and demand for helper decreased significantly due to the fear of contracting the virus. It is likely that stranded workers overseas will reduce the transfer of their income to their family due to lower income during the lockdown, with many may also opting to go back to their home country after losing their job. The importance of this income transfer could not be underestimated. It has largely offset the sizeable, 12% of GDP goods trade deficit and is one of the main sources for the country’s foreign currency inflow.

Meanwhile, Indonesia is running a small goods trade surplus, with non-oil & gas trade surplus weighed down by oil & gas trade deficit. The country, however, is much less reliant on foreign income and hence less vulnerable to the shocks arising from the current crisis (Chart 10). In the long run, both the IDR and PHP fluctuation correlates well with their current account balance (Chart 11). Going forward, as the global growth normalize, it is likely that Philippines will see a larger current account deterioration relative to Indonesia, driven largely by the recovery of imports. This should weigh the PHP down and result in underperformance relative to the IDR.

Bottom line: Long Indonesia/short Philippines 10-year local-currency government bond; long IDR/PHP; long Indonesian 10-year government bond