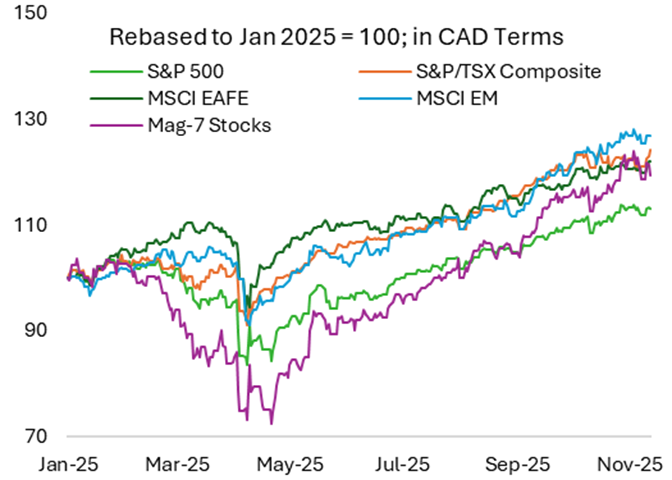

Unlike in 2023 and 2024, however, 2025 YTD (as of November 11) saw a very healthy broadening of the global equity rally, with Canada, International and Emerging Market equities clipping an even better return, especially when translated into a common-currency terms (Figure 1). Perhaps more interesting is the fact that Magnificent-7 stocks have also lagged, despite the very strong rally in the second half of the year. We see this trend continuing in 2026 amid its elevated valuation and earnings expectations.

Figure 1. Return across global equity indices as of November 11, 2025

As we get closer to the end of the year, the backdrop for risk assets remains favourable. There are concerns about the book quality of private credit lenders that have aggressively raised funds in the past years, but we expect the impact on the broader financial system to be rather limited. The Federal Reserve is still on its monetary easing trajectory as worries on the softening U.S. labour market eclipses the upside risk on inflation, and corporate profit growth is expected to continue grow at a healthy double-digit pace next year. The path of monetary policies, however, will be more varied as many global central banks are near or at the end of their rate-cut cycle, including Canada, while others are still expected to ease further. Japan is an outlier as the Bank of Japan is expected to hike its policy rate amid booming domestic economy and above-target inflation.

For most households and politicians, the seemingly never-ending debate on cost-of-living crisis will likely take center stage as we approach the U.S. mid-term election. But this is only a part of global phenomenon where the younger generations – increasingly dissatisfied by their job prospect and poor affordability of housing and daily necessities – are demanding greater accountability from their governments. Increasing public spending for a more distributive policy, however, necessitates increasing taxes as well – an unpopular policy for any politicians that will have significant implication on the topic of fiscal sustainability and term premium. This makes boosting productivity growth even more important across developed and developing world, which brings us to potential for AI.

We expect AI adoption across households, enterprises, and government to enter its J-curve in 2026. We have observed efforts across industries to hire talents with the goal of integrating AI into their daily business activities, all the while pulling back on junior employee hiring. To facilitate this increase in adoption, the world needs not only advanced chips but also the development of energy infrastructure to power all the data centers being built.

In the current edition of Eight Things to Watch, we highlight themes that we believe will shape financial market development in the new year.

- AI penetration and utilization enter the J-curve, boosting productivity and corporate profitability

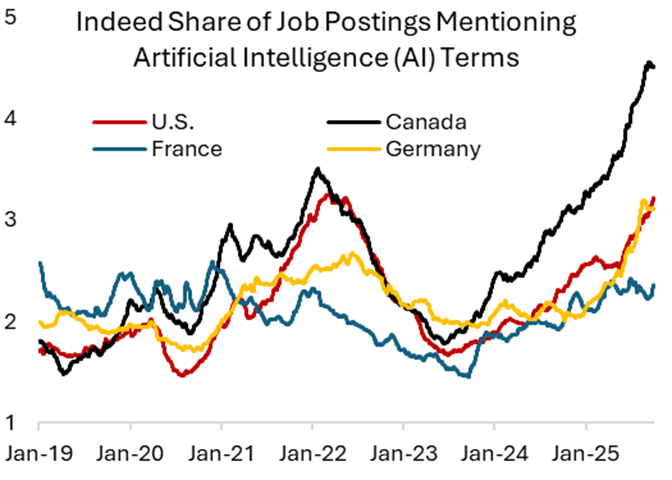

It’s early days for AI adoption, but research shows white-collar workers in the info tech, finance, and businesses tend to see greater benefits of using AI in their daily work so far. This is worrisome for the job prospect of younger folks who tend to perform entry-level tasks and are now competing with AI. Brynjolfsson, Chandar, and Chen highlight that early-career workers in the most AI-exposed occupation saw 13% relative decline in employment compared to negligible change for workers in less exposed fields. For instance, OpenAI hired more than 100 ex-investment bankers to help train its AI on how to build financial models – grunt work that has been performed by junior bankers. Participants are paid $US150 per hour to write prompts and build financial models, which has the potential to help do entry-level tasks at investment banks. Figure 1 shows that across the developed world, jobs mentioning AI terms have increased, which reflect the efforts across industries to leverage AI in their business process. The ability of AI to automate repeated, mundane tasks that up until recently have been done by fresh graduates and younger workers will make it harder for them to get their foot on the door for entry-role corporate job.

Figure 1. Accelerating adoption and integration of AI across the developed world

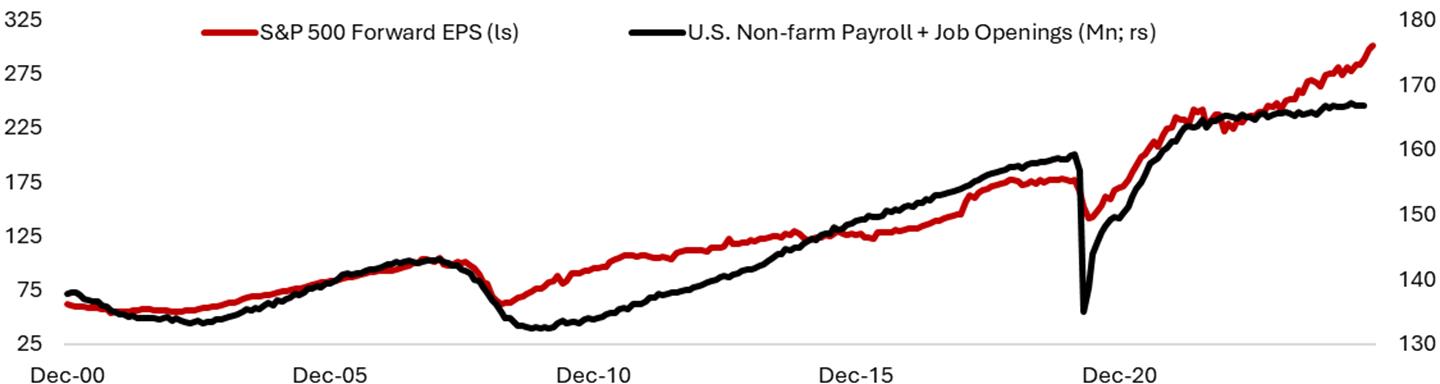

Figure 2. U.S. total job demand has flatlined despite the boom in profits

- Increasing pressure for world’s governments to spend and affordability problem going into the U.S. mid-term election

Cost-of-living crisis remains a hotly debated topic for economists and politicians across the world and will likely take center stage as we approach the U.S. mid-term election. The sharp increase in prices over the past four years and weakening job market more recently have made life more difficult for most households, which may partially explain the reason consumer confidence has been depressed despite the booming stock market and strong economic growth. This is also perhaps the reason we have seen more headlines of anti-government protests across both the developed and developing world.

Figure 3 shows the number of protests globally that are driven by either failure of political representation or economic injustice. In general, an increase in global food price tends to be followed by an increase in the number of protests, as highlighted by the 2011 Arab Spring revolution and 2022 Russian invasion of Ukraine – the world breadbasket. In 2025, frustrated young people led anti-government protests in Indonesia, Nepal, Peru, Morocco, Kenya, and Madagascar. These are generations that grew up seeing an improvement in their parents’ quality of life and failed to see it in recent decade. Increasingly dissatisfied by their job prospects and poor affordability of housing and daily necessities, they are demanding greater accountability from their governments.

There are changing dynamics in who and how people are protesting across the developed and developing world, with more educated elite taking a role in pushing for greater accountability from their government. History tells us that the most dangerous element in society comes from people who have seen their expectations of a better life dashed by reality on the ground. The higher the level of education of the unemployed masses, the more extreme the destabilizing behavior that results, said political scientist Samuel P. Huntington from Harvard University. Alexis de Tocqueville called the French Revolution a revolution of rising expectations. The Arab Spring revolution of 2011, for instance, was driven mainly by university graduates who failed to secure jobs.

The affordability issue will likely become an important debate topic going into the U.S. mid-term election. Despite all the populist rhetoric in the surface, however, eventually it is how voters feel about their quality of life that matters for the incumbent. Figure 4 shows that the approval rating of President Trump is loosely correlated to consumer confidence, which has been declining. This bodes poorly for the Republican going into the mid-term election in 2026 and increase the pressure for the government to increase social spending to win voters. Increasing public spending, however, necessitates an increase in taxes – an unpopular policy for any politicians – or issuing more debt. If governments across the world choose the latter, the bond market will likely push back by demanding higher term premium for government’s long-term borrowing.

Figure 3. Increase in food prices tend to be followed by mass protests globally

Figure 4. Incumbent’s approval rating is well correlated to how consumers feel about their personal situation

- USMCA joint review and reshoring efforts boosting FDI flow into the U.S.

We expect policy uncertainty to have reached its peak in April 2025 and set to continue to decline in 2026 as the most disruptive policies from President Trump’s administration were already front-loaded in the first year of his presidency. This should provide a more stable backdrop for investors and attract permanent capital from the rest of the world through foreign direct investment (FDI) into the U.S.

The ongoing USMCA joint review that ends July 1st, 2026, will also shape the direction of capital flow and trade across North America, with the U.S. aiming to leverage access to cheaper labour on the South and abundant commodity resources in Canada. In 2025, U.S. tariffs on imports from Canada and Mexico have disrupted the trilateral economic relationship, including in the auto supply chains and industries consuming steel and aluminum, leaving the trade-weighted average tariffs of 9.8% for Canada and 5.2% for Mexico.

If the announced commitments from goods and pharmaceutical manufacturers to build production facilities in the U.S. are indeed followed-through, we could expect FDI to remain strong next year. Despite the heightened policy uncertainty in the first half of 2025, FDI into the U.S. accelerated and was above the previous decade’s average. Historically, this translated to a tailwind for the U.S. dollar (Figure 5).

Reshoring to the U.S. will likely focus on more advanced manufacturing goods, rather than the low-tech consumer goods that currently dominates imports from China. Given the economy of scale and competitiveness of Chinese exports, it is unlikely that U.S. consumers could switch to other suppliers in the medium term, but this raises the need for China to diversify its customer base – and look towards Europe, Middle East, and Southeast Asian countries.

Figure 5. Increasing FDI into the U.S. amid reshoring efforts could support the greenback

- The focus on AI will turn from Chip to Power

McKinsey forecasts that data center energy demand will rise from 224 TWh currently to 606 TWh by 2030, which translates to an annualized growth rate of 22% (Figure 6). On the supply side, however, many utility companies in the U.S. have lagged in expanding the grid’s available power and transmission infrastructure – leaving electricity supply growth in the coming years significantly below the surge in demand. In the meanwhile, this has translated to much higher electricity bills for households living near data center facilities, with 70% of the households living within 50 miles of data center facilities seeing a significant jump in electricity costs compared to five years ago.

The fact is that it takes almost a decade to build traditional nuclear power facilities, with developers having to wait for government permits, line up buyers for the future output, and hire thousands of skilled workers. And critical parts of a plant, such as reactor vessels and steam generators, can take as long as four years to be manufactured and delivered. All-in-all, it could take 10 years or more to plan and build a traditional nuclear reactor. Meanwhile, small modular reactors (SMR) still take around 2-5 years to build and have yet to produce commercial power.

Until these nuclear facilities are built and integrated into the grid, natural gas will play an important role in powering data centers, at least in the U.S. Figure 7 shows IEA forecast for data center power generation by source globally. In the coming decade, the bulk of the growth will be mainly coming from nuclear and renewable sources. But in between now and 2035 natural gas will be the primary source of energy to power data center. Note that since the normalization of natural gas prices following Russian invasion of Ukraine, prices have risen to $4.6/MMBtu as of time of writing from as low as $1.57/MMBtu in February 2024. This is significantly above the average natural gas prices between 2010 and 2019.

Figure 6. Data center energy demand will rise at a double-digit rate in the coming years

Figure 7. Natural gas will play an important role as a bridge power source before nuclear infrastructure becomes operational

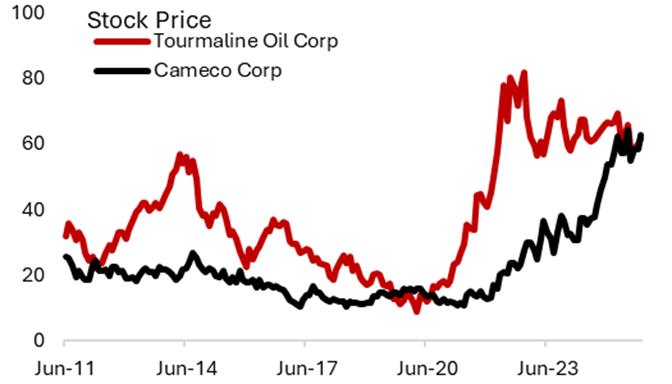

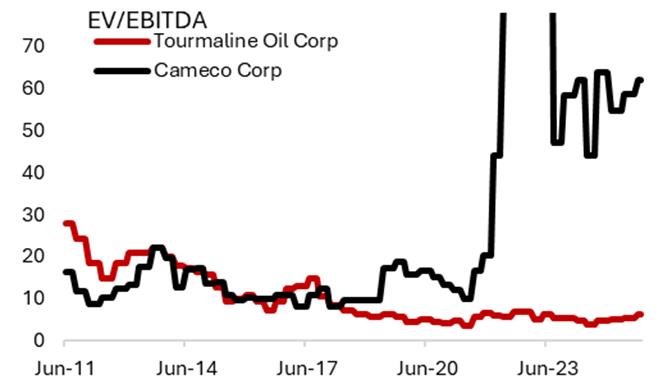

For investors, this could mean a barbell strategy of buying both natural gas producers and uranium miners to capitalize on the surge in data center energy demand. However, investors need to brace for volatility as valuation for nuclear miners is relatively rich, especially compared to conventional energy producers (Figure 8).

Figure 8. There is huge gap in the valuation of natural gas and nuclear producers

- Calling for 2% inflation for most regions, with the U.S. labour market likely to remain soft

The lack of U.S. economic data amid government shutdown has made it more difficult for investors to assess the underlying strength of the U.S. economy in Q4/25. However, commentaries from U.S. companies reporting in the most recent quarter and private surveys highlight that the inflationary impact of tariffs seem to be manageable, with more focus on the weakening labour market and consumer spending in the lower and middle-income group. Figure 9 shows that consumer expectation of inflation in the coming year has fallen over the past six months, albeit still elevated. Worryingly, increasing share of households now think that unemployment will be higher in the coming year as the pace of job growth likely has fallen to below potential and layoff is increasing in many industries – as suggested by the job opening data from Indeed and recent Challenger job reports.

The good news is that central banks across regions will likely see inflation coming down closer to 2% by the end of 2026. Figure 10 shows that economists expect inflation in the U.S. to end at 2.5% by end of 2026, and 2% or under for other regions. A gradual return of central banks’ credibility could cool the rush towards real assets such as gold, whose price rose over 60% in 2025.

Figure 9. Concerns on inflation is gradually shifting towards the softening labour market in the U.S.

Figure 10. Except for the U.S., inflation is projected to hit 2% or below in most region by the end of 2026

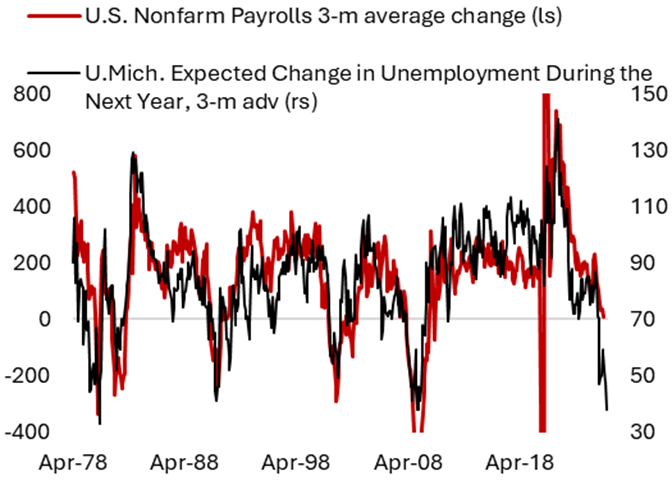

The risk is that the U.S. labour market slipped into contraction and consumer spending follow. Although we remain in the low hiring, low firing environment in the last quarter of the year, leading indicators are ominous. Figure 11 highlights that households’ employment expectations have markedly deteriorated, which historically indicates the direction of job gains in the subsequent quarter. At the same time, Challenger job reports point to a jump in job cuts announcements by companies in the private sector (Figure 12). Watch this space.

Figure 11. U.S. households expect unemployment to increase in the coming year, highlighting the deteriorating labour market outlook

Figure 12. Challenger job reports saw a sharp increase in job cuts announcement, but jobless claims remain relatively low

- Monetary policy to diverge

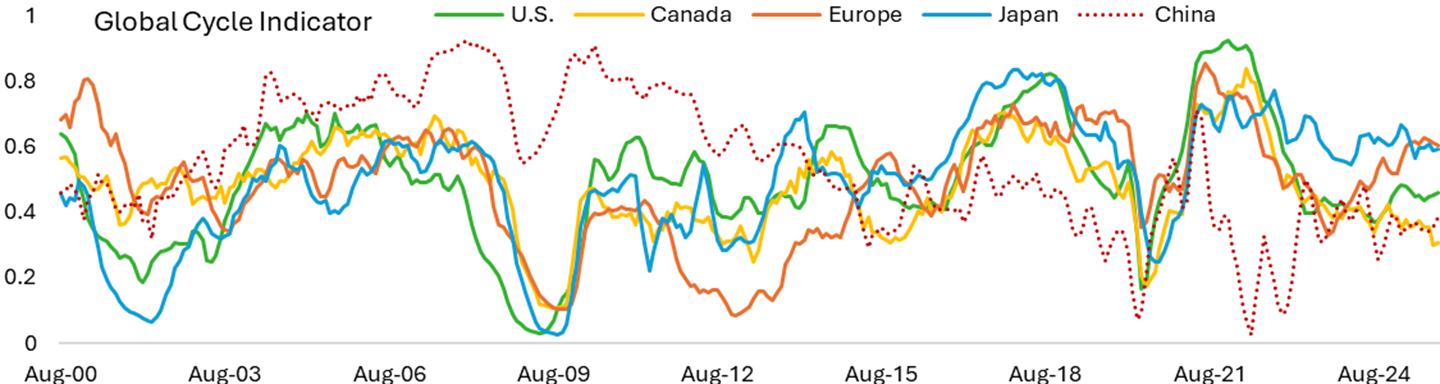

One of the myth investors often believe in is the existence of a global economic cycle, when in fact each region tends to move individually in their own business cycle that translates to a diverging monetary policy across major central banks (Figure 13). For instance, the Bank of Canada has been cutting policy rate much earlier and more aggressively compared to the U.S. Federal Reserve, mainly due to weaker Canadian economy. Meanwhile, the Bank of Japan continue to see above-target inflation and vibrant domestic economy, which skew the bias towards more policy rate hike. All these create divergences in the path of monetary policy and provide opportunities for bond and currency traders.

Figure 13. European business cycle has picked up in advance of both U.S. and Canada

Japan is a special case given that all other developed market’s central banks are biased towards further monetary policy easing. This pushed long-term yields for the Japanese bonds higher, especially vis-à-vis other G7 government bonds (Figure 14). Japan’s new Prime Minister, Sanae Takaichi, said that her government’s domestic policy agenda will include support for a more proactive government spending – a continuation of Abenomics – that should bolster economic growth. Today, the Bank of Japan is still expected to increase its policy rate even as the U.S. and the rest of developed world’s central banks remain on the rate-cutting path. This should put upward pressure for the Japanese Yen against the U.S. dollar.

Figure 14. Bank of Japan is the only major central bank still planning to hike policy rate, in contrast to other G7 central banks

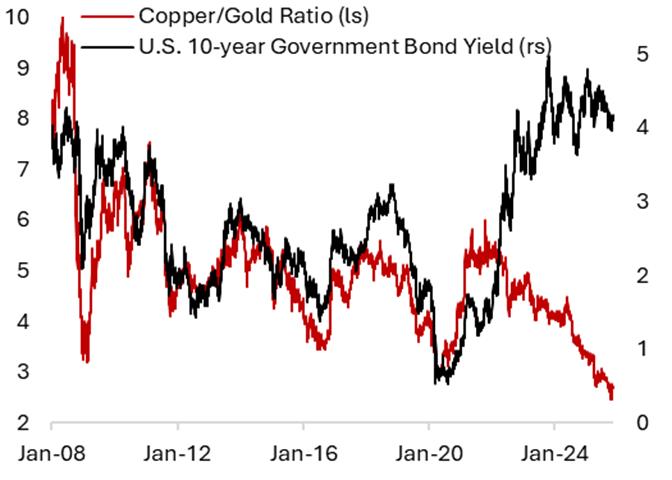

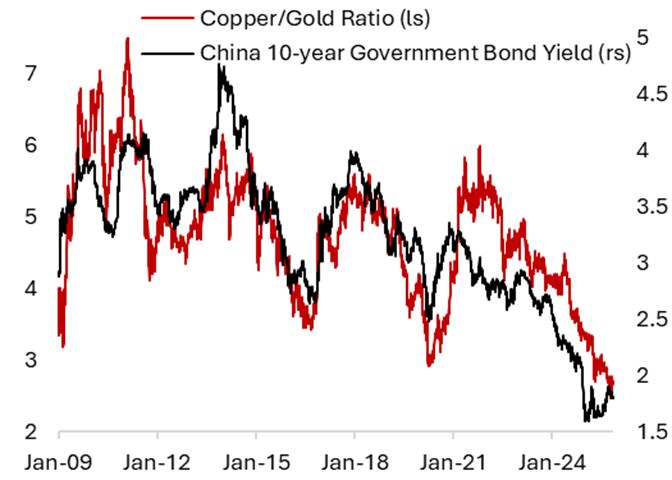

As U.S. exceptionalism gradually diminishes with its growth rate converging to the rest of world, we could also see a narrowing in the gap to the rest of the world. This could mean the narrowing of copper-to-gold ratio and U.S. 10-year yield, in which the former has been dragged down in recent years by the slump in Chinese economic activity (Figure 15). We are of the view that Chinese business cycle has seen the trough, but the economy will stay weak and see deflationary headwind amid structural issues such as aging population and private sector deleveraging, although policymakers will likely react with more pro-growth stimulus if domestic demand relapse.

Figure 15. The divergence between copper-to-gold ratio and U.S. 10-year yield is driven primarily by China’s economic weakness

- Improving U.S. Cyclical Outlook

In-line with the previous theme #6, we see three main drivers that support potential upswing in the U.S. business cycle next year: 1) fiscal stimulus from OBBBA, 2) impact of monetary easing by the Fed, 3) decline in policy uncertainty. All these are tailwinds for the U.S. economy and favourable for the outlook of domestic cyclical sectors. There are budding signs of recovery in both the manufacturing and service sectors.

The U.S. ISM Manufacturing report remain in contractionary territory in October, but much of the decline is driven by reduction in inventories and slight downtick on production, while new orders and employment improved. The continued uptrend in new orders relative to inventory ratio suggests an improved outlook for manufacturing and cyclical-sector activity in the coming quarter. Following two years of contraction in manufacturing activity, the outlook for the sector is improving going into 2026.

On the service sector, U.S. ISM Services PMI point to a healthy expansion with the headline index rising to 52.4 in October from 50.8 in prior month and majority of the sub-components in expansion except for employment. The upbeat number on U.S. service sector suggests that likely we are still in a goldilocks environment where monetary policy is on the easy side while underlying economic growth held up between 1% and 2%. Figure 16 shows that activity in the service sector tends to accelerate one year following the decline in long-term yields. The release supports a more positive outlook for U.S. economic growth in the coming year.

Figure 16. Leading indicators are pointing to an acceleration in both manufacturing and service sector activity

If the U.S. labour market stabilizes and consumer spending start to pick up again, then we could see deeply-discounted industries such as trucking and homebuilders outperforming (Figure 17). But we believe it is too early to go long these beaten-down sectors now.

Figure 17. Cyclical and rate-sensitive sectors have massively underperformed

- Peak of U.S. equity weight in MSCI ACWI

The outperformance of U.S. equities in the past fifteen years have translated to its weight in global equity benchmark rising to record high of around 65% at the beginning of 2025 (Figure 18). Considering that the top 10 names in the S&P 500 has seen significant rise to 42% of the U.S. benchmark, this means global equity concentration has been rising as well. Increasingly, the U.S. stock market and economy are driven by AI. Even sectors that are not directly related to technology have seen surge in demand for things related to building AI infrastructure, such as gas turbines in the industrial sector, heavy machinery required to build data centers, and electricity and grid expansion in the utility sector. In the first half of 2025, investments in non-residential structures that include data centers have similar GDP growth contribution compared to consumer spending, despite the former accounting for only 15% of the U.S. economy (consumer spending accounts for roughly 70% of the U.S. GDP).Given the rich valuation and high concentration of the U.S. index, improving economic outlook for the rest of the world, and greater downside risk for the U.S. consumer spending, we think equity market share of U.S. equity will decline going forward.

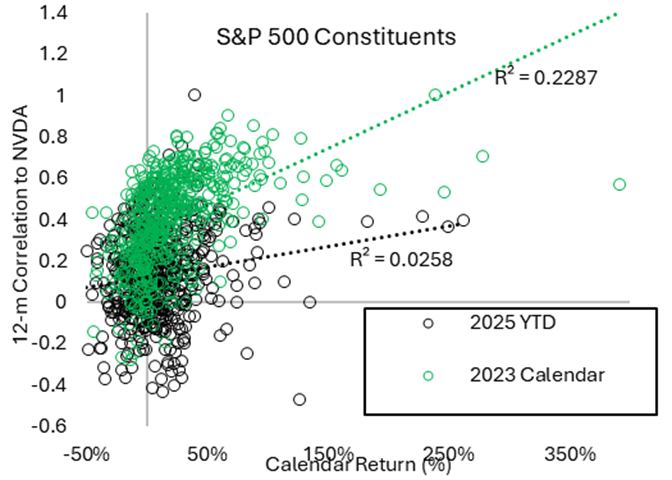

Mega-cap tech stocks still dominate the return of U.S. equities this year but compared to in 2023 when the AI theme was just getting started, this year we observed a more differentiated return drivers for the majority of stocks in the S&P 500 index. In Figure 19, we measure the correlation of monthly return between stocks in the S&P 500 index and Nvidia – a proxy for the AI theme – and also plot their respective calendar return for 2023 and 2025 YTD. First, there were more stocks with higher correlation to Nvidia in 2023 compared to today, as suggested by the higher distribution of the green circles on the y-axis. Second, in 2023 there was stronger positive relationship (steeper slope for the green line compared to the black line) between the correlation of S&P 500 members’ return to Nvidia and their respective calendar performance. In other words, stocks that performed well in 2023 tend to be closely tied to the AI theme. This relationship is weaker in 2025. Lastly, the explanatory power (or R-squared) of this relationship is much higher in 2023, which suggests factors outside the AI theme playing a larger role in driving the majority of stocks’ return this year. Expect larger numbers of return drivers in 2026.

Figure 18. U.S. equity market cap as percentage of total world equity is at two decades’ high

Figure 19. Stocks in the S&P 500 have seen more differentiated performance drivers outside AI in 2025 compared to in 2023

Copyright © 2025, Putamen Capital. All rights reserved.

The information, recommendations, analysis and research materials presented in this document are provided for information purposes only and should not be considered or used as an offer or solicitation to sell or buy financial securities or other financial instruments or products, nor to constitute any advice or recommendation with respect to such securities, financial instruments or products. The text, images and other materials contained or displayed on any Putamen Capital products, services, reports, emails or website are proprietary to Putamen Capital and should not be circulated without the expressed authorization of Putamen Capital. Any use of graphs, text or other material from this report by the recipient must acknowledge Putamen Capital as the source and requires advance authorization. Putamen Capital relies on a variety of data providers for economic and financial market information. The data used in this publication may have been obtained from a variety of sources including Bloomberg, Macrobond, CEIC, Choice, MSCI, BofA Merrill Lynch and JP Morgan. The data used, or referred to, in this report are judged to be reliable, but Putamen Capital cannot be held responsible for the accuracy of data used herein.