It is often said that the invention of steam engine in the 18th century was one of the world’s greatest inventions in the past one thousand years. The printing press, electric lightbulb, vaccination, and computer are also among the top of the list. These inventions are considered great not solely due to their direct usage for humanity, but also because it lays the groundwork for other future inventions to be built.

The printing press, first founded in the 14th century, ease the distribution of information and knowledge to broader population at a faster speed. Together with the invention of telephone by Alexander Graham Bell in the 19th century, it cuts the time for information to interweave around the world from weeks to days. The mass adoption of radio and television reduces the friction for information to go global, which was further bolstered by the availability of the internet. Whereas finding answer to a question used to take at least few hours in the library, ChatGPT could now answer it within seconds.

Looking ahead, the development in Artificial Intelligence (AI) capabilities will likely transform the way we learn and work, potentially boosting productivity growth among white-collar workers. With knowledge easily available at the fingertips of every human being on the planet, will university education become obsolete or even more crucial than before? Many online course providers have seen their business collapsed in 2024 amid students shifting towards ChatGPT to help them solve homework from their school or university. Will programming remain a skill worth learning for university graduates when AI could write the whole syntax? Things are changing, fast, and they present opportunities for investors who could spot these trends early.

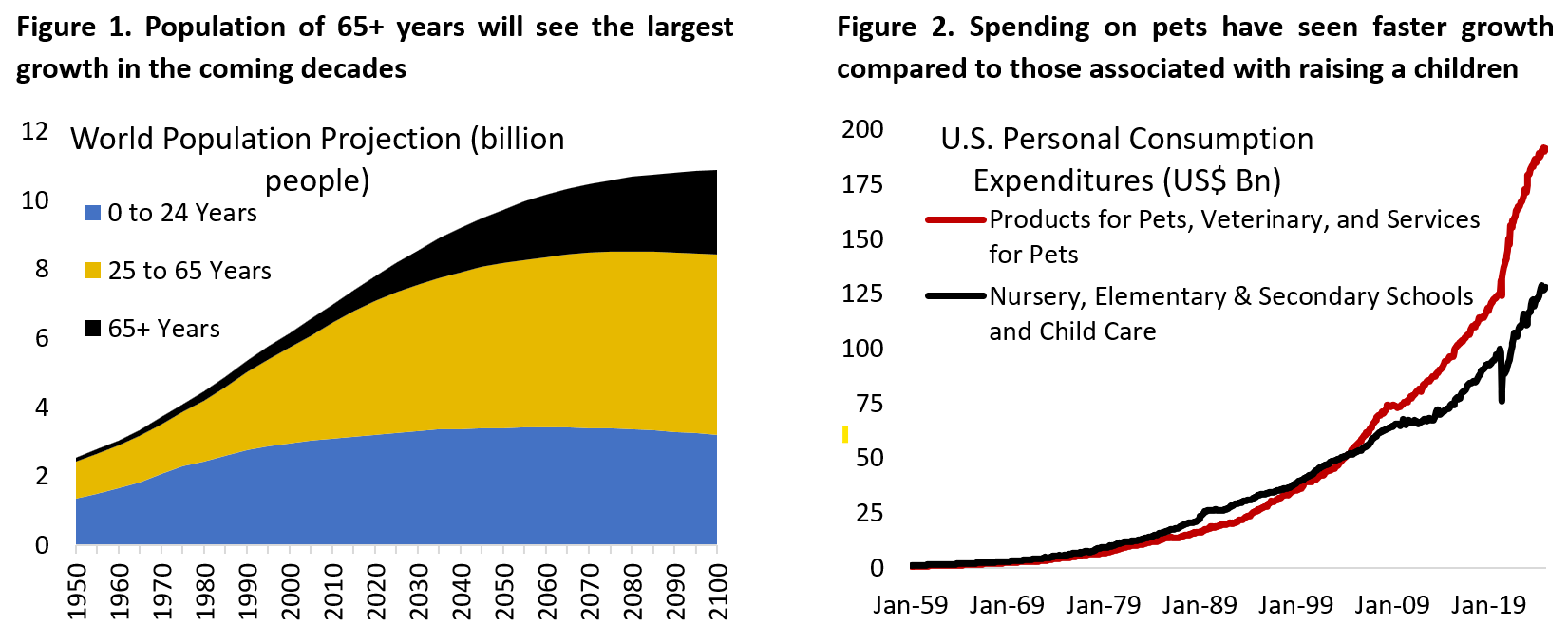

Technological developments are not the only change that is shaping our world today. The world’s demographic is also changing with the younger generations having fewer children and people living healthier for longer across both developed and developing countries (Figure 1). Heart condition and cancer remain two main leading cause of death globally, but the focus currently to prevent these diseases from surfacing in the first place, which include fighting chronic diseases such as diabetes and obesity. The market size for GLP-1 analogues (US$47 billion in 2024), which help reduce blood sugar levels in diabetic patient and reduce body weights, is expected to grow more than 20% annually for the coming decade.

The longer lifespan and better health condition allow the average person to work longer and once they are retired, turn more of their accumulated savings and pensions into discretionary spending. For instance, other than the constantly growing demand for senior living space, the business of cruise line has seen a sharp rebound following the pandemic. Among younger generations, their decision to have fewer children has translated to more of them having a pet – a boom for the industry that now has a market size bigger than childcare-related spending (Figure 2).

Within discretionary spending, consumers across the generation are also shifting their spending preference towards services. Since the turn of the millennium, spending growth on food services and hotels have been outpacing those for discretionary goods, excluding the brief period during the pandemic (Figure 3). Perhaps it is not surprising that LVMH, the French luxury goods company, has been branching its offering to luxury experience through the acquisition of Belmond in 2018.

This shift in spending pattern matters for the economy and financial market as service spending has generally seen lower cyclicality compared to those for goods. This could mean that the high and low of the business cycle will be less extreme going forward. Figure 4 shows that the contribution of cyclical sectors to U.S. GDP has fallen from 31% in 1997 to 21% currently. Meanwhile in Europe, the PIGS (Portugal, Italy, Greece, and Spain) have seen an economic boom amid surge in tourism and the tailwinds of economic reform following the 2011 Euro Crisis. Contrast this with the ailing German economy amid its dependence on manufacturing and industrial activity – battered by both the high energy cost following Russian invasion of Ukraine and the electrification of the auto sector led by China (Figure 5).

Following the pandemic, U.S. economic resilience amid aggressive monetary tightening by the Federal Reserve has surprised lots of investors. But many variables have indeed change, including the role of government in the society. The U.S. government has continued on running large fiscal deficit long after the pandemic emergency has passed and the economy growing above trend. Across the developed world, governments are taking more responsibility in providing social spending, including education and healthcare, and pension income. This has led to a sizeable fiscal deficit and rising public debt that potentially bring the bond vigilantes back alive. It remains to be seen whether President Trump administration will be able to reverse this trend with the Department of Government Efficiency headed by Elon Musk. In French, President Emmanuel Macron have tried to control the fiscal deficit by cutting spending with little success amid strong backlash from voters. It is ironic that French government bond is now yielding more than those of Southern European countries. The recent success of libertarian President Javier Milei reforming public spending in Argentina is something worth watching.

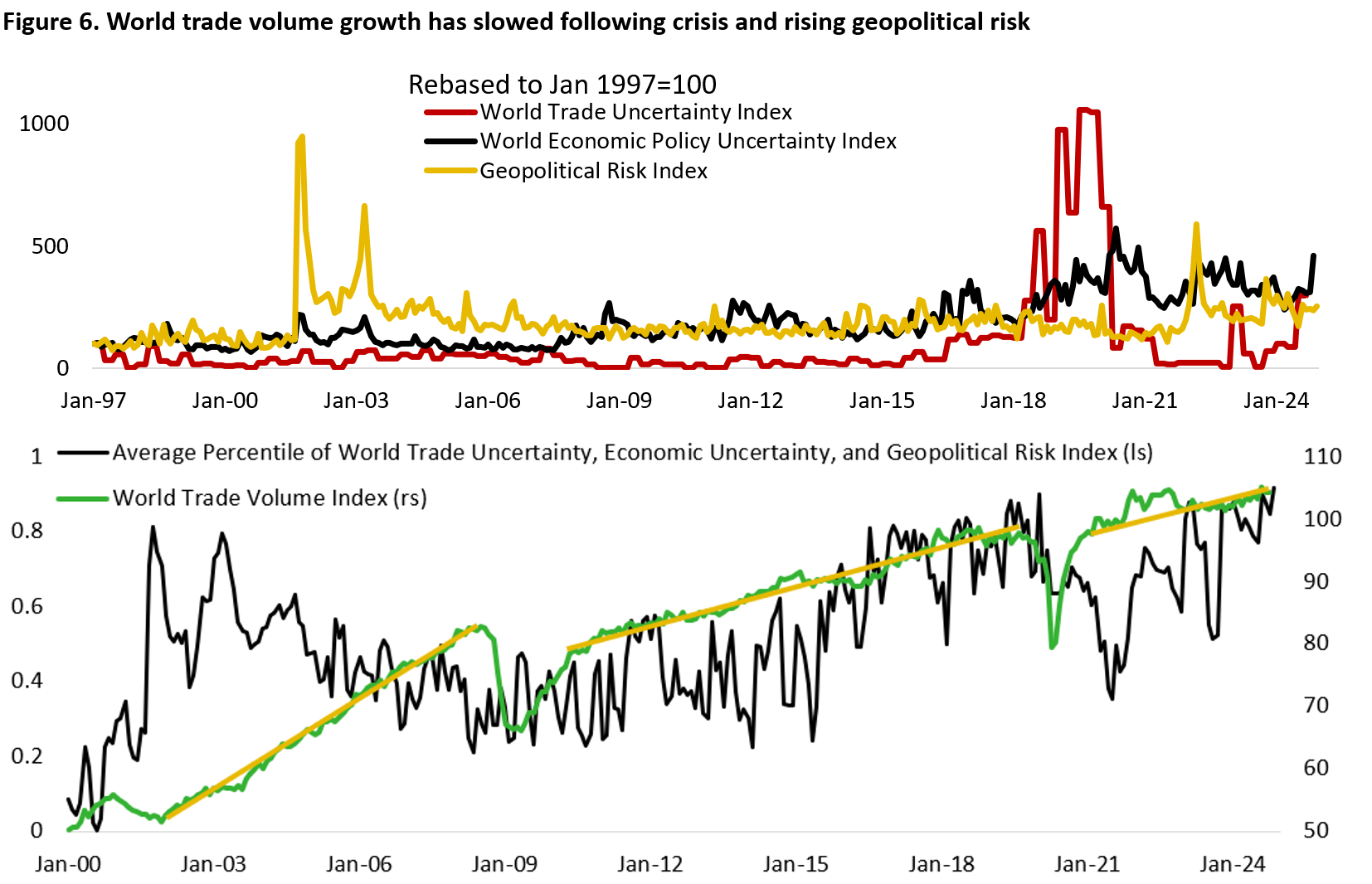

Other than domestic issues, the external environment has also become more hostile for global trade and investment. The U.S. is shifting its focus towards the rivalry with China and withdrawing from its role as the world’s police in other parts of the world. As the old saying goes, “when the cat’s away, the mice will play.” Regional players are fighting to shift the power balance in their favour, including in the Middle East where Israel with the backing of the U.S. practically neutralized the multi-pronged threats from Iran by weakening its allies in Gaza, Lebanon, and Syria. With global cooperation on the decline, geopolitical risk will increasingly be on top of mind for executives in finding new market to expand, build a factory, or source raw materials. The top panel of Figure 6 shows the world have seen rising uncertainty on three different aspects: geopolitical risk, trade, and economic policy – the uncertainty trinity.

Now with the U.S. and Chinese government responding tit-for-tat sanctions on the export of sensitive technology and materials, the disruption in global supply chain is translating to an increase in cost for businesses and consumers. From trade perspective, the backdrop of globalization is also slowly shifting towards protectionism. Whereas the decade following China joining the WTO in 2001 has seen rapid growth in global trade, this slowed significantly post-GFC and the pandemic. China, the world’s factory over the past two decades, is now itself facing rising labour cost, aging demographic and political changes that push multinationals to outsource their manufacturing base to other countries across Asia, such as Vietnam for electronic manufacturing and Bangladesh for textile. The threat of import tariffs may alter the calculation for companies up in the value chain on whether to outsource their manufacturing overseas or build it in the U.S. soil. Automation is likely the primary beneficiary of this as management look for various avenues to cut cost.

Economic policy uncertainty will also remain elevated this year considering more than 60 countries went to the polls in 2024 – mostly with the incumbents losing. In the U.S. and Europe, we have seen voters shifted to the right amid dissatisfaction on center and center-left governments that were in power during the inflationary period following the pandemic.

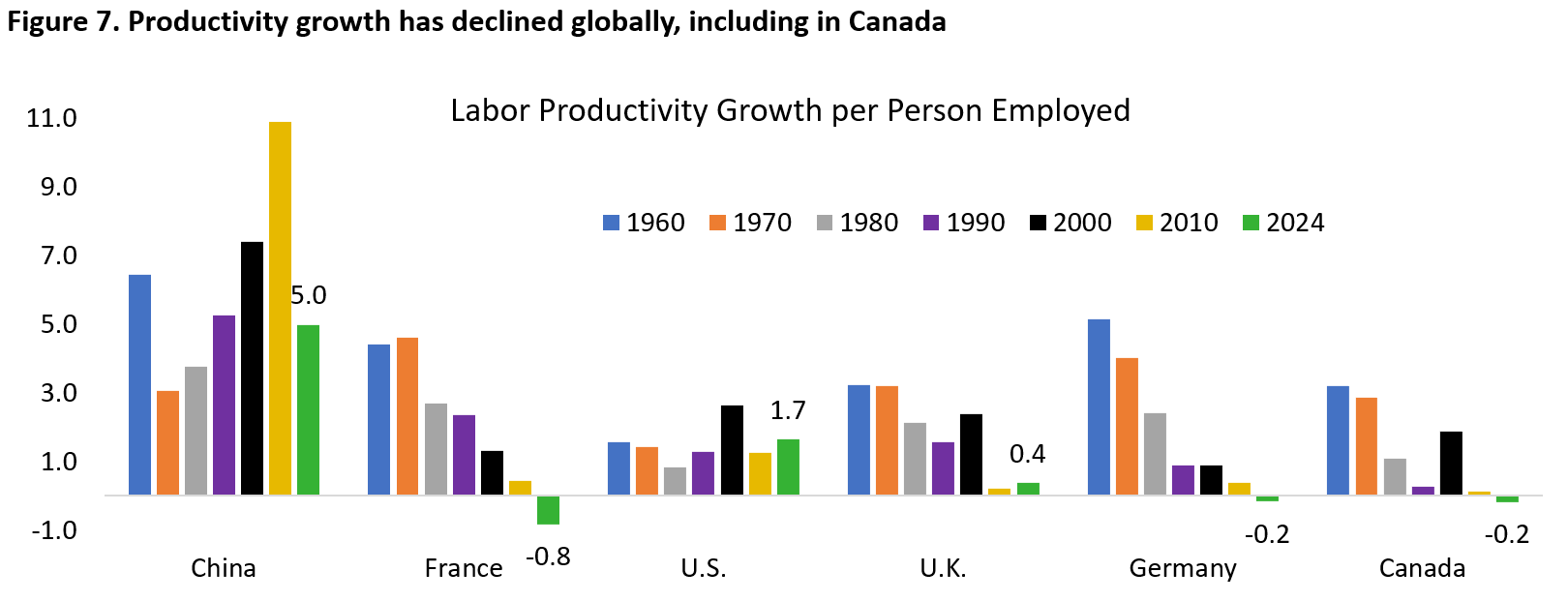

Canada is in a perilous position weathering the increasingly hostile global environment. As one of the most interest-sensitive developed countries amid high household debt and high share of cyclical sectors in the economy, Canada has seen disappointing growth post pandemic. Our open economy and dependence on energy exports put Canada in a relatively fragile position globally compared to consumer-heavy economy such as the U.S. Moreover, Canada is facing a wide range of domestic issues, including housing affordability, intra-provincial trade barriers that hamper growth, and chronically low productivity.

The change in geopolitical landscape, however, present opportunities for Canada to adapt to the need of the world and its southern neighbor. Canada’s abundant supply of energy resources and critical minerals could substitute Chinese supply of the latter, integrating Canada to the high-tech supply chain. In addition, deregulation among several key industries such as the energy and manufacturing sector could potentially boost the much-needed productivity growth (Figure 7). Our elected government needs to present Canada as the more attractive investment destination compared to other developed countries. In a world where growth is scarce, investors are willing to bid on companies that could innovate and deliver consistent sales and earnings growth. We need to make sure Canada is a place where such companies could thrive.

Lastly, the direct financial impact of climate change is increasingly felt by all stakeholders. The blazing fire in California in January is now estimated to cost insurers up to US$20 billion and alter the life of millions of people. Property & casualty insurers are no longer willing to cover for housing in high-risk areas, such as Florida and South Carolina. Higher temperature is changing the acidity of grapes and shifts winery region into northern area where the temperature is cooler. Meanwhile, tourists are also increasingly flocking to Scandinavian countries in the summer to escape from the heat in Southern Europe. Water scarcity is also exacerbating conflicts across Africa and further raise the risk of low-scale war between local tribes.

The energy landscape is also changing with renewed focus on nuclear as clean energy source. Today there are fewer resistances to building nuclear reactors and small modular reactor (SMR), with several big tech firms already announcing agreements to purchase the energy output to feed burgeoning demand from AI. The decision by German government to phase out nuclear energy increasingly look like a mistake (the last nuclear power plants were shut down in April 2023; the government committed to phase out all nuclear power plants following 2011 Fukushima disaster).

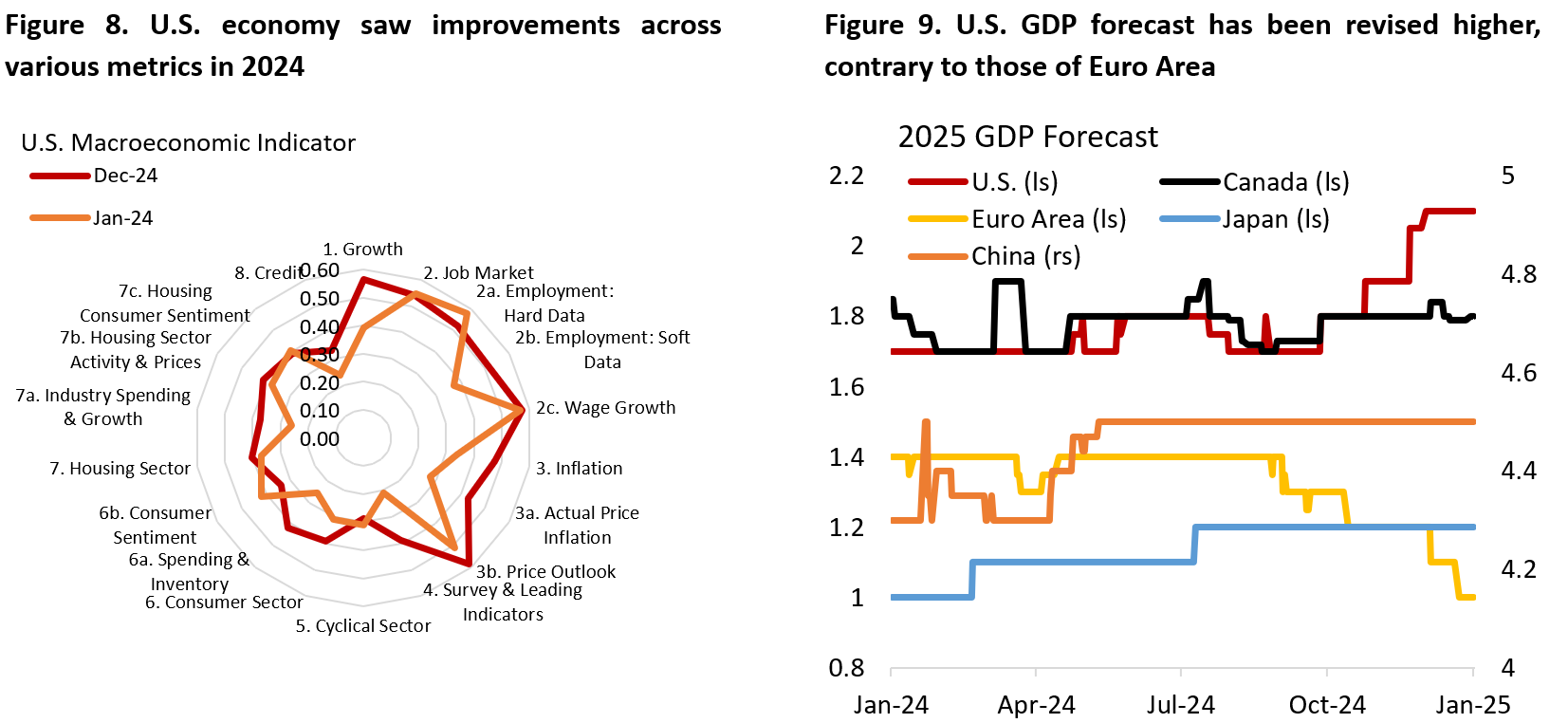

“This time it’s different”, is said to be the most dangerous phrase in finance. But the facts above show that the world has indeed changed. This time around, the U.S. economy barely saw a slowdown even after the Federal Reserve began its most aggressive monetary policy tightening in four decades, although in hindsight this is helped largely by the very loose fiscal policy. In fact, the U.S. economy saw improvement across various metrics in 2024, with the exception of employment that is still on softening trajectory (Figure 8). This year, economists think U.S. exceptionalism is likely to continue, even as the rest of the world limp (Figure 9).

The U.S. exceptionalism could probably best be illustrated by very strong performance of the greenback, which is near its two decades’ high relative to America’s trading partners (Figure 10). The higher yield offered investing in U.S. government securities and capital inflow into U.S. equities have supported the dollar’s appreciation. However, extreme net long positioning on the greenback means it is prone to a pullback if U.S. economic outlook start to deteriorate or the rest of the world see a growth recovery. Note that the greenback has followed a 7-10 year bull and bear cycle and we are potentially near the end of this bull cycle that started following the Euro Crisis in 2011.

The contrast between U.S. and the rest of the world is also reflected in the yawning gap between U.S. yield and copper-to-gold ratio (Figure 11). As the 10-year yield in U.S. is back to 4.7% – the high in 2024 – China’s fell to below 1.7% from the high of 3.4% in 2020. We need to remember, however, that the economy and the financial market has a self-correcting mechanism. First, strong dollar is deflationary for the U.S. economy as it reduces import prices for many the goods and services Americans consume. Second, weak economic outlook in the rest of the world could eventually weigh on U.S. growth once the impact of fiscal policy diminishes.

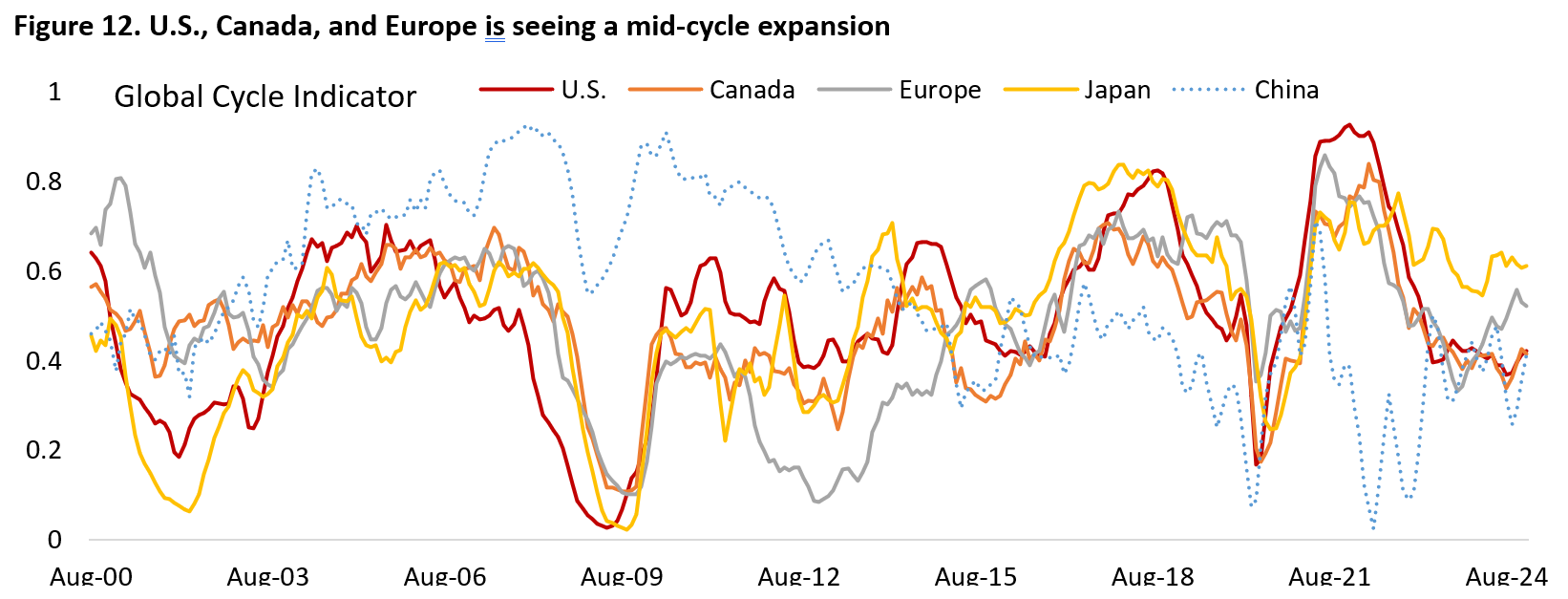

From a cycle perspective, we are potentially entering a mid-cycle expansion phase in most developed countries, with the exception of Japan, as manufacturing PMIs stabilizes while services remain strong. We define this phase of the business cycle a as period of recovery in the cyclical sectors following a non-recessionary slowdown, i.e. the U.S. economy in 2013 and 2016. The still ongoing monetary policy easing by the Fed, Bank of Canada, European Central Bank, and People’s Bank of China is a tailwind for growth and should help activity in the interest-sensitive sectors to pick up (Figure 12). Encouragingly, we have seen new orders ticked higher relative to inventories for the manufacturing sector – a leading indicator for the headline index (Figure 13).

In 2025, I think we could retire the debate on soft vs hard landing as arguably the U.S. economy has indeed soft-landed. One only need to look at U.S. equity valuation and bond spreads to see that optimism that is baked in the financial market. The U.S. labour market remains in balance, with U.S. companies in a low hiring, low firing mode. Without a clear negative catalyst for the economy and financial market, asset valuation could remain high.

Where to Invest Today?

The back-to-back 20%+ return on U.S. equity index has brought the S&P 500 valuation to a rich level, driven mainly by the outperformance of mega-cap tech stocks. With the concerns on the U.S. economy shifting from recession to overheating and inflation being stickier than expected, investors has bid up prices of cyclical and growth stocks and drove yields higher. Households’ allocation to U.S. equity is near all-time high and futures positioning on the U.S. equity market is near the bullish extreme. The relevant question today is where to allocate amid the backdrop of U.S. Equity trading at 22x earnings and bond yields potentially marching further higher? Can 2025 be the year when investors would finally be rewarded from allocating to the forgotten international and emerging market stocks?

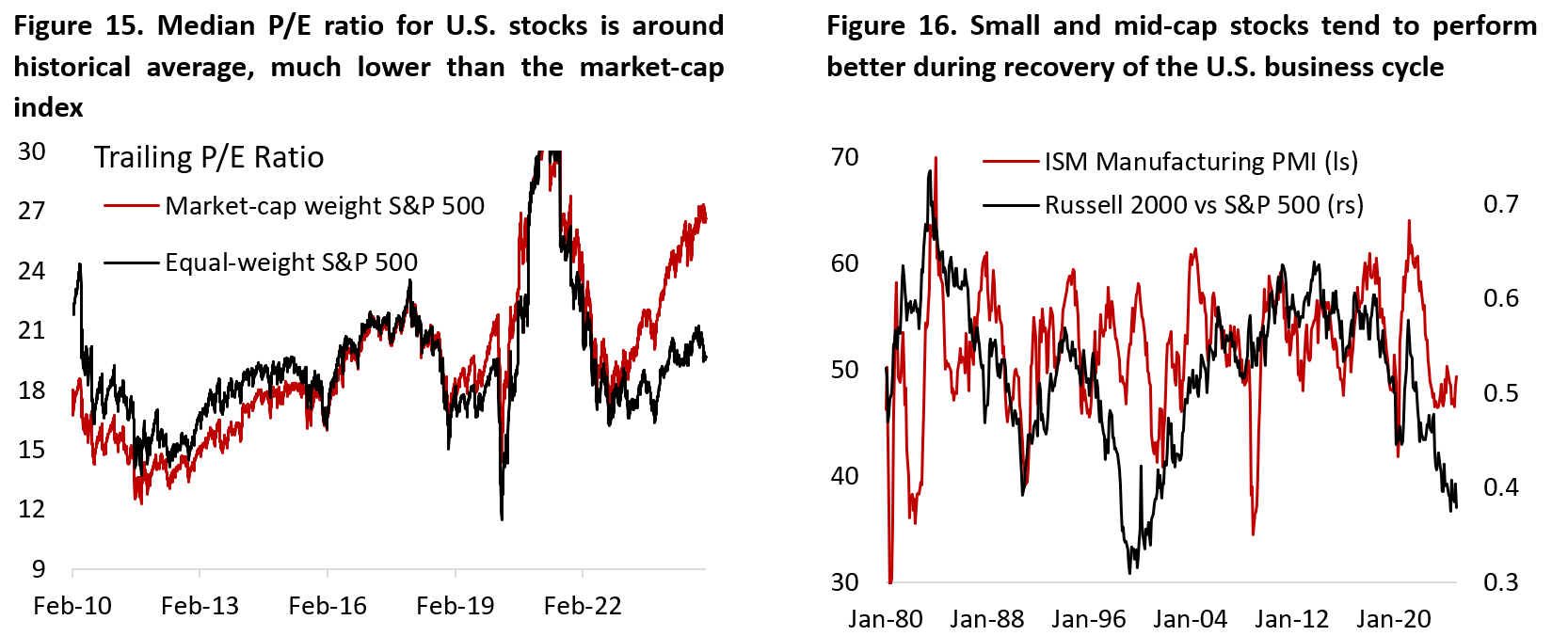

The good news is that U.S. stocks are still expected to deliver on the earnings front, with earnings per share forecast to grow at a healthy 14% this year. The downside risk primarily comes from the elevated valuation multiples, which have been rising despite the back up in long-term yields – driving equity risk premium into negative level. But investors would be remiss to simply ignore U.S. stocks based on an expensive headline index. Yes, the U.S. equity index screens expensive based on all traditional valuation metrics, but there are opportunities in the left-behind stocks down the market cap and outside the info tech sector (Figure 15). Our base case scenario of an upswing in the manufacturing PMI means the risk/reward trade-off for stocks down the market-cap tier and cyclicals are becoming more attractive (Figure 16). In fact, analysts expect earnings for small-cap U.S. stocks to grow 44% this year, outpacing large-cap stocks (Figure 17).

The rise of passive investing means large-cap stocks take an increasing share of dollar inflow allocated to the asset class, while small and mid-cap stocks receive fewer coverage and allocations over time. The composition of the U.S. stocks itself has been changing over time, with innovative sectors taking larger share of the index (Figure 18). Even active managers have been chasing the mega-cap tech stocks as it moves higher due to the fear of materially underperforming the benchmark. For active U.S. equity managers in 2023 and 2024, diversifying from the S&P 500 benchmark weights hurts their average performance.

The performance dispersions between U.S. and international (MSCI EAFE) and emerging market (MSCI EM) stocks are also reaching extremes, with the average sector in EAFE and EM trading at 30-40% discount relative to the U.S. counterpart despite some expected to see similar or even higher growth (Figure 19). This is especially true in the “old economy” sector such as industrials, materials, energy, and utilities.

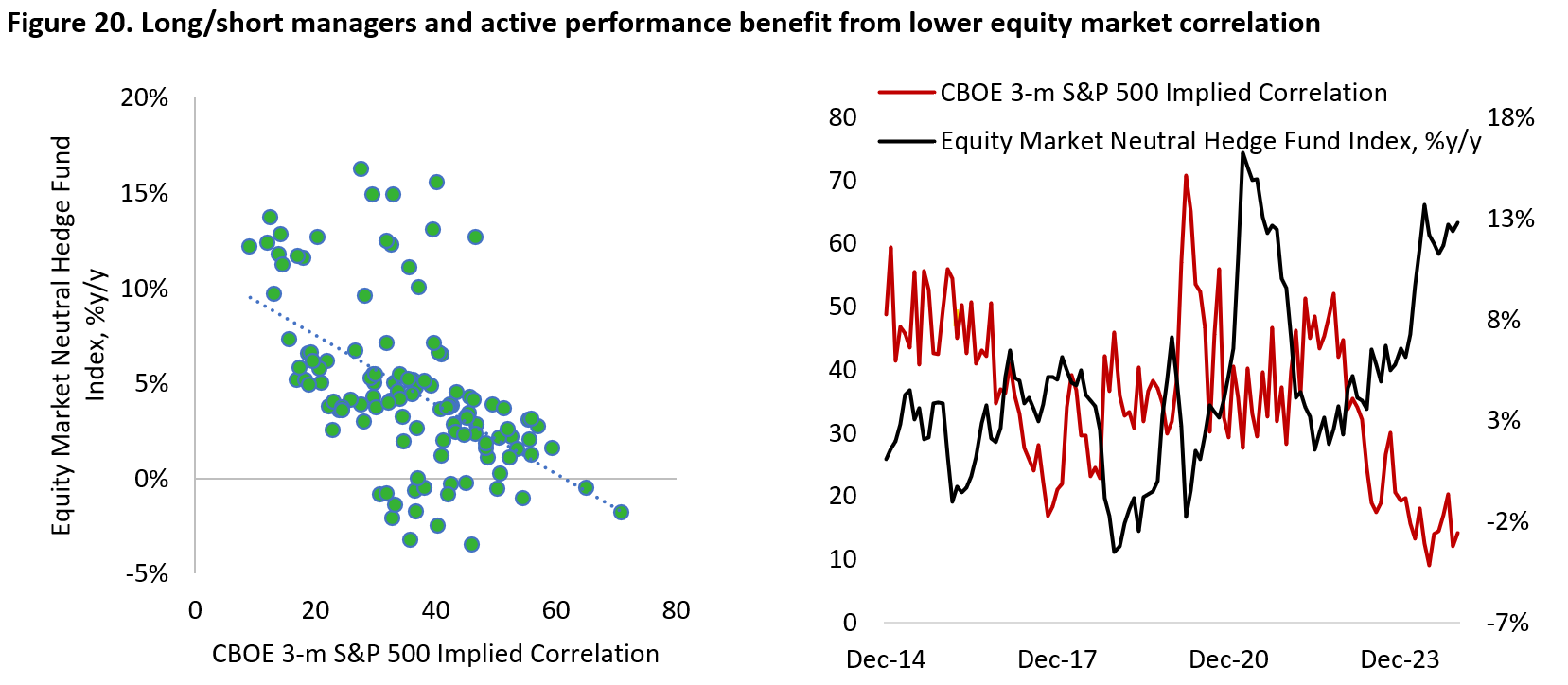

Following two years of multiple expansion in U.S. stocks, investors could also de-risk their portfolio by substituting beta exposure with alpha strategy. Long/short and market neutral strategies tend to perform better during period of declining and low correlation within the equity market – as had been the case in 2024 (Figure 20). If the equity market broadens this year, as we expect, stock prices will increasingly be driven by idiosyncratic company factor rather than macro forces – a boon for active managers.

Lastly, the availability of private capital also allows companies to expand without tapping capital in the public market, essentially shifting the availability of investment opportunities to private equity and credit players. The slow IPO and M&A activity is delaying the exit of portfolio companies in the private space and rewarding investors in the private equity secondary strategy as liquidity providers. On the fixed income side, private credit is becoming a competitive player against traditional bank lending for small and mid-size company that could not tap the bond market. The leveraged loan market has also seen strong inflow due to its floating rate structure, presenting an alternative to traditional bond investment.

Copyright © 2025, Putamen Capital. All rights reserved.

The information, recommendations, analysis and research materials presented in this document are provided for information purposes only and should not be considered or used as an offer or solicitation to sell or buy financial securities or other financial instruments or products, nor to constitute any advice or recommendation with respect to such securities, financial instruments or products. The text, images and other materials contained or displayed on any Putamen Capital products, services, reports, emails or website are proprietary to Putamen Capital and should not be circulated without the expressed authorization of Putamen Capital. Any use of graphs, text or other material from this report by the recipient must acknowledge Putamen Capital as the source and requires advance authorization. Putamen Capital relies on a variety of data providers for economic and financial market information. The data used in this publication may have been obtained from a variety of sources including Bloomberg, Macrobond, CEIC, Choice, MSCI, BofA Merrill Lynch and JP Morgan. The data used, or referred to, in this report are judged to be reliable, but Putamen Capital cannot be held responsible for the accuracy of data used herein.