With the benefit of hindsight, 2024 turned out to be a much better year for investors compared to the relatively downbeat expectations earlier in the year. The U.S. stock market continued to roar, delivering 20%+ return, following a 22% return in 2023. Meanwhile, returns for fixed income also turned positive as global central banks started to ease monetary policy. Positive development on Artificial Intelligence continues to be the main driver for equity market and geopolitical risk premium continues to decline amid stalemate in Russia-Ukraine war and limited global impact from the war in Middle East. U.S. economy remains to the strongest vis-à-vis other developed and emerging economies, driving capital inflow into U.S. assets and the dollar. In sum, many of the trends that began in 2023 extended to 2024.

The victory of President-elect Trump has revived market’s “animal spirit” with deregulation, tariffs, and tighter immigration policy back in focus. Market is taking lessons from President Trump’s first administration and his staff picks for the White House. Stocks, especially cyclical sectors, have rallied hard following the election date while bond yields rose amid expectations of higher inflationary pressure due to broad-based tariff on goods import. Despite all the forecasts that deemed to be market consensus today, however, it is important to keep an open mind. Few analysts expected at the start of the year for the Fed to start its policy easing cycle with a 50-bps rate cut, the French government bond to yield higher than Spanish and Portuguese counterpart, or for gold to reach all-time-high on the backdrop of stronger dollar and higher yields.

Uncertainty is the only certainty, and investors should aim to limit the cost of being wrong. Sentiment is currently euphoric amid expectations of a boom in America’s economy, and some hangover may be in the making. With that said, below we list several mini themes that are on top of our mind going into the new year.

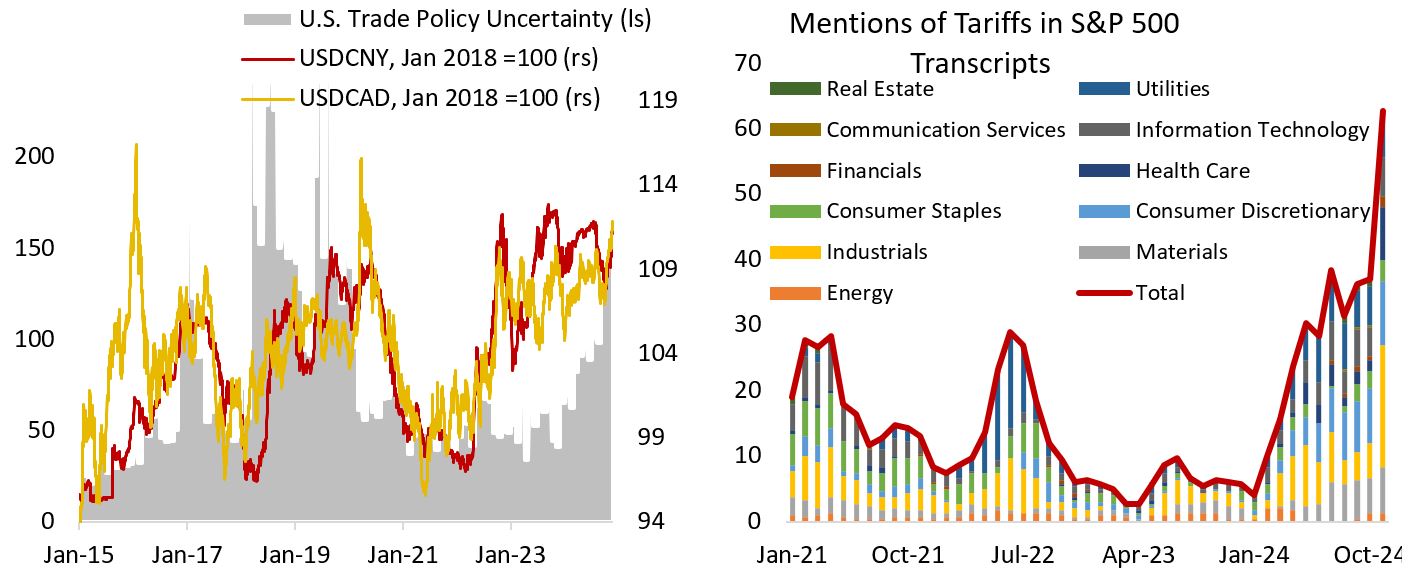

1. Rising uncertainty related to global trade bode poorly for the currency of countries reliant on exports to the U.S., including the Chinese Yuan, Mexican Peso, and Canadian Dollar. The implementation of tariffs for U.S. goods imports will accelerate the reshoring trend seen since the 2018 trade war. Companies are increasingly rethinking their supply chain, especially those in the industrials and consumer discretionary sector due to their complex operation and dependance on parts from all over the world.

2. U.S. economy continues to outperform the rest of world, including Canada. Large contribution from domestic demand including consumer spending makes the U.S. economy less sensitive to what is happening globally, which could not be said for many European and Asian economies. The backdrop of elevated geopolitical and trade uncertainty, stagnating globalization, and increasingly protectionist policies have all made the U.S. a haven for capital to move into. In this environment, expect the greenback to stay bid despite its overbought and expensive valuation. Meanwhile, Canadian economic outlook will remain hinged on what is happening in its southern border and to oil price.

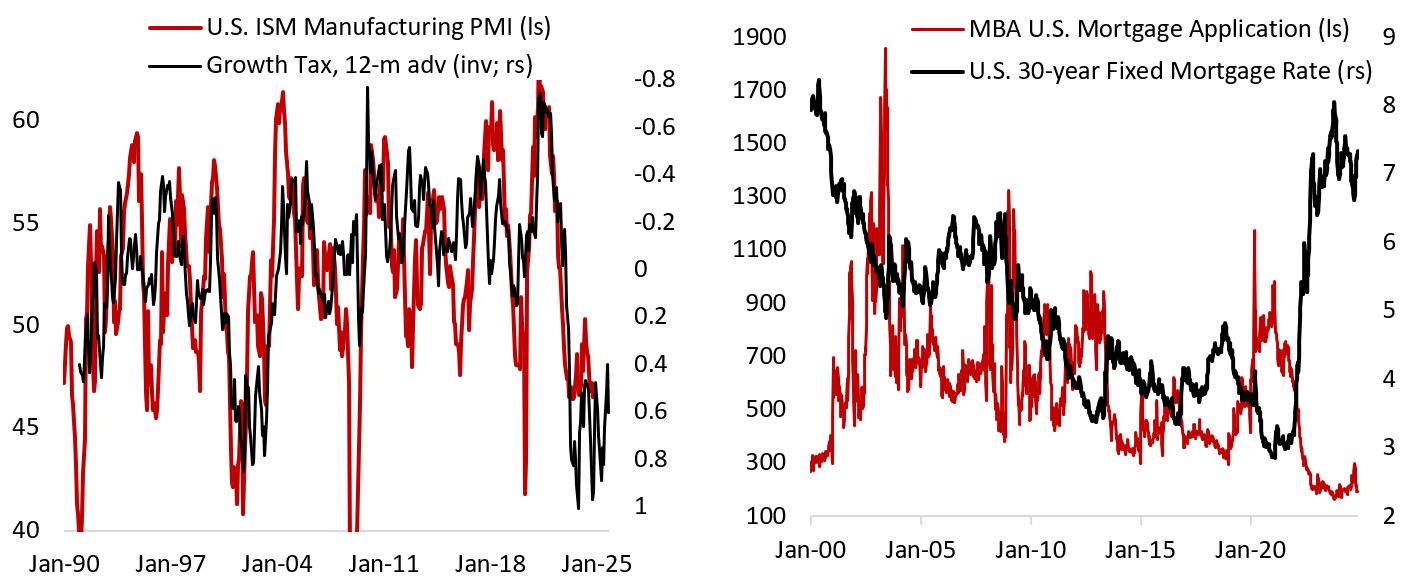

3. U.S. business cycle is very likely to pick up amid ongoing monetary easing and potentially looser fiscal policy under President Trump administration. The manufacturing and housing sector are due for a rebound following two years of lackluster activity, which should accelerate in 2025 as monetary policy eases and rising likelihood of fiscal policy remaining supportive for growth.

4. Fiscal and sovereign debt sustainability likely to come into focus. Rising share of non-discretionary fiscal spending across the developed world forced the British and French government to enact greater spending discipline in 2024. Bond vigilantes have awaken after four decades of structural decline in long-term yields. Currently, French government is yielding higher compared to similar maturity bonds issued by Germany, Portugal and Spain. This is quite a reversal from the European sovereign debt crisis in 2012-13 when Portuguese and Spanish government bonds were yielding as high as 12% vs around 3% for Germany and France. Following the U.S. presidential election, investors are now focusing on the U.S. fiscal and debt outlook.

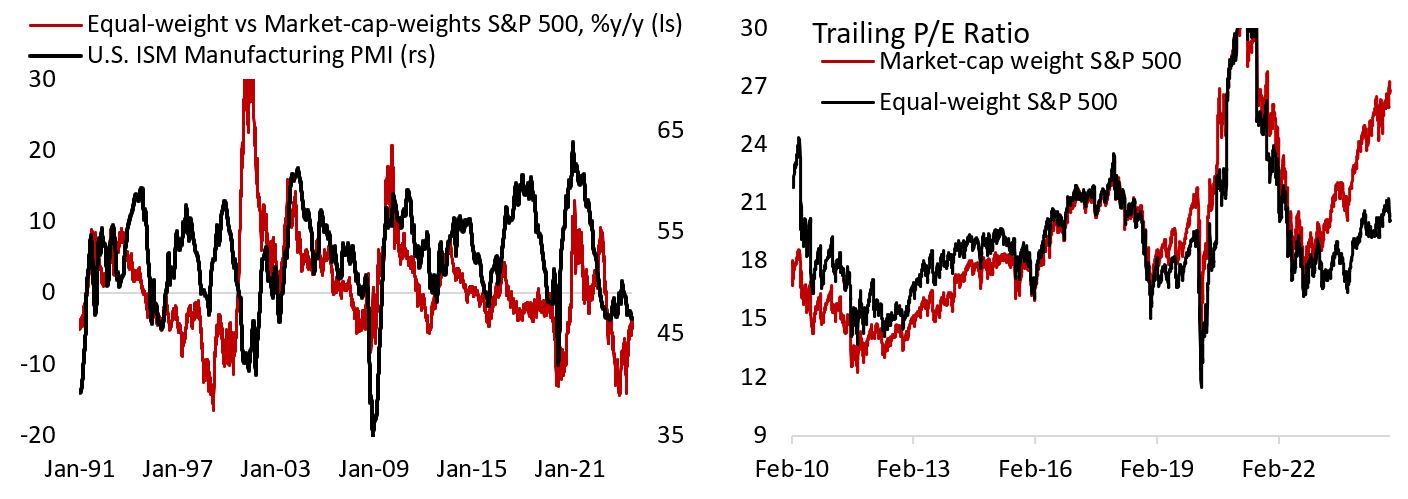

5. U.S. stocks remain the place to be, but drivers of equity market return to broaden away from the mega-cap stocks. An acceleration in the U.S. business cycle historically bodes well for companies in the small and mid-cap tier. As manufacturing PMI improves, equal-weight S&P 500 index tend to outperform its market-cap-weight counterpart. In addition, mega-cap earnings growth is trending lower and converging to the rest of the index, while valuation for equal-weight U.S. stock index is much more attractive currently.

6. Geopolitical risk will remain in the forefront of investors’ mind, with gold demand remaining strong. Gold prices have doubled since 2019 and structural demand from global central banks will remain robust as policymakers are shifting their reserve preference from paper to real assets. The U.S. sanctions imposed to Russia following its invasion of Ukraine have increase the attractiveness of holding physical gold, which is immune to seizures. In addition, gold is a hedge against currency debasement by governments to manage their real debt load.

7. Business sentiment is set to improve as U.S. growth outlook is firming up. Inflation continues to trend lower and the labor market has fully normalized, which assuage fear of rising input cost. If the labor market does not deteriorate materially from here, consumer spending should remain healthy and allow revenue and earning to grow close to historical trend rate.

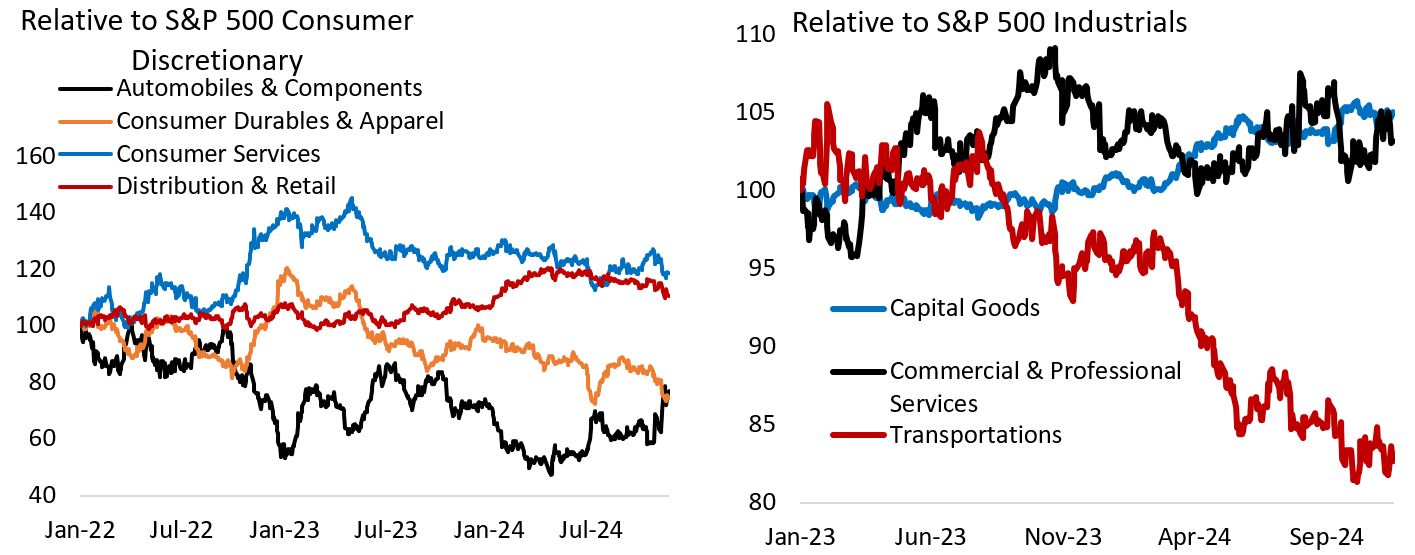

8. Expect intra-sector rotation within the consumer discretionary and industrial sector. Weak manufacturing activity and boom in consumer spending since H2/22 have translated to the outperformance of consumer services sub-sector while both automobiles and transportations have been exceptionally weak. In-line with our thesis of an acceleration in the U.S. business cycle, we expect this trend to reverse in 2025.

9. U.S. crude oil production will reach another record high while OPEC+ discipline will be tested. Transition towards renewables and weak Chinese economic activity have weighed on the outlook for crude oil demand in 2024, which is expected to continue in 2025. The bright side is that O&G companies’ focus on shareholders’ return should boost share prices and exposure to crude oil is a tail hedge for geopolitical risk as tensions in Middle East will likely remain elevated. Iran produced some 3.34 million b/d, around 3% of total global supply. If these flows are temporarily disrupted, prices would likely surge until OPEC nations, which have around 5 million b/d of spare capacity, ramped up their production.

10. Fund flows into equity and bond will continue to be strong amid plenty of cash on the sidelines. As global central banks continue to lower policy rate closer to neutral, inflows to equities and bonds have both recovered in 2024 following an outflow and 2022 and below-historical rate inflow in 2023. Currently, there are $6.7 trillion of money market funds sitting on the sidelines, with $2.7 trillion belonging to retail and $4 trillion to institutional client base.

11. Equity risk premium and credit spreads to end up higher by 2025 year-end. The rally in risk assets have pushed valuations for both equity and credit to a all-time-high levels by the end of 2024. Corporate high-yield spreads are at the tightest level in the past 30 years – last seen just prior to the Global Financial Crisis and burst of the tech bubble. Meanwhile, equity risk premium is also at the lowest level over the past twenty years. Market sentiment is currently euphoric and will likely need adjust lower as left-tail risk increases.

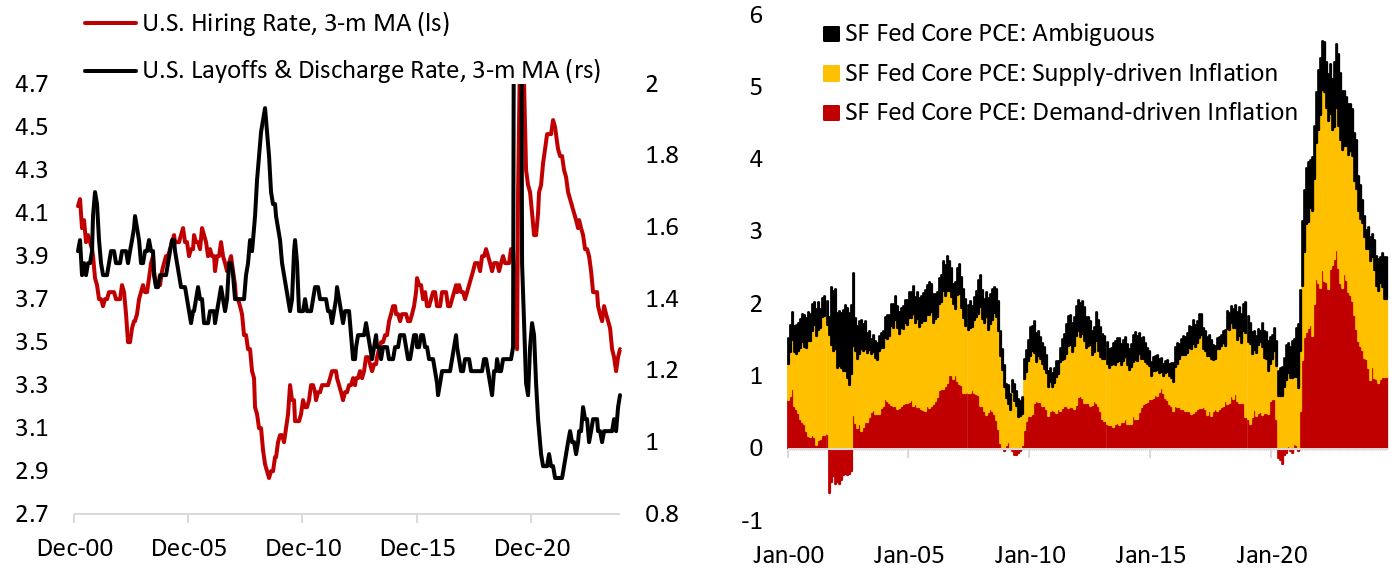

12. Job gains will continue to slow in 2025 and the outlook for inflation is a tricky one. In October, quit and hiring rate has fallen to the level last seen during global financial crisis. So far, layoff rate is still much lower compared to pre-pandemic level, although the trend is rising. The inflation outlook for 2025 is a tricky one as demand-driven inflation will need to decline further for inflation to hit the Fed target of 2%. A lower demand, however, may force companies to layoff more workers to maintain their margin. On top of this, supply-driven inflation may see an upside surprise if tariffs on goods imports are implemented.

13. Credit growth is set to accelerate, and corporate interest expense will rise as companies refinance their debt. Easing lending standard for large enterprises should boost loan growth next year as capex cycle resumes. Lower rate, however, does not mean companies will see their net interest expense declining. This is because borrowing rate today is still much higher compared to in 2021/22 when corporate America issued bonds at record-low rate prior to the Fed’s monetary tightening cycle.

Copyright © 2024, Putamen Capital. All rights reserved.

The information, recommendations, analysis and research materials presented in this document are provided for information purposes only and should not be considered or used as an offer or solicitation to sell or buy financial securities or other financial instruments or products, nor to constitute any advice or recommendation with respect to such securities, financial instruments or products. The text, images and other materials contained or displayed on any Putamen Capital products, services, reports, emails or website are proprietary to Putamen Capital and should not be circulated without the expressed authorization of Putamen Capital. Any use of graphs, text or other material from this report by the recipient must acknowledge Putamen Capital as the source and requires advance authorization. Putamen Capital relies on a variety of data providers for economic and financial market information. The data used in this publication may have been obtained from a variety of sources including Bloomberg, Macrobond, CEIC, Choice, MSCI, BofA Merrill Lynch and JP Morgan. The data used, or referred to, in this report are judged to be reliable, but Putamen Capital cannot be held responsible for the accuracy of data used herein.