Downlaod PDF: Emerging Market Bonds

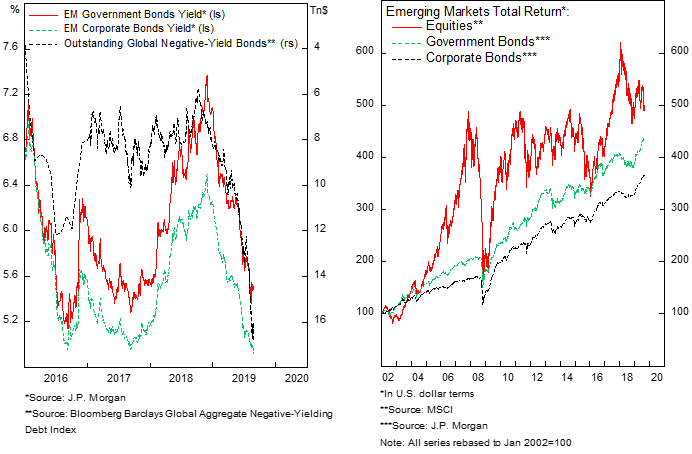

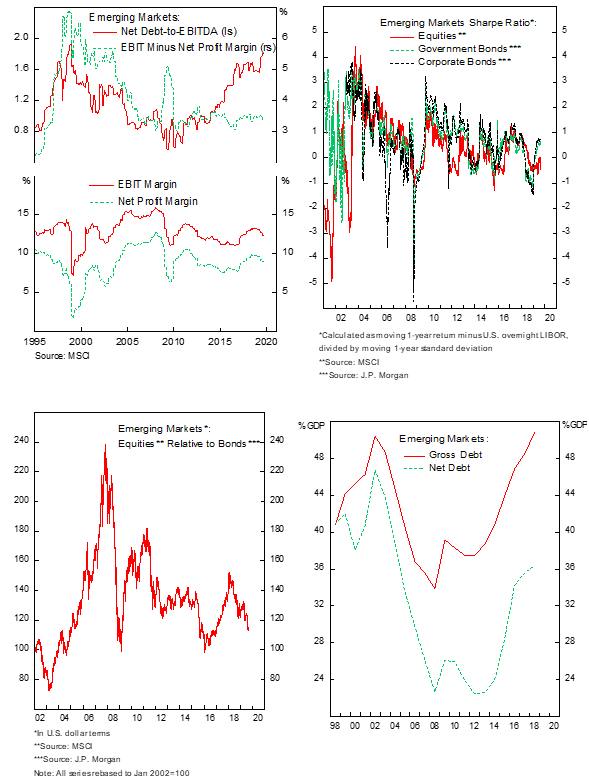

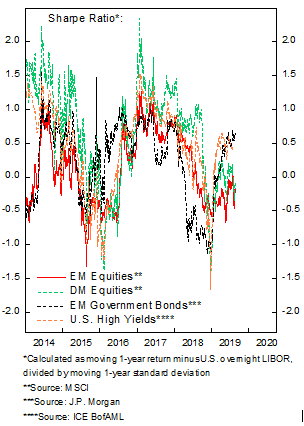

- High-yielding EM government and corporate bonds are likely to perform well in negative yields environment as investors search for yield. Although debt level has been rising, interest cost has been declining. Profit growth has also been outpacing the increase in interest cost, which does not translate the increase in debt into higher vulnerability for EM government and corporates.

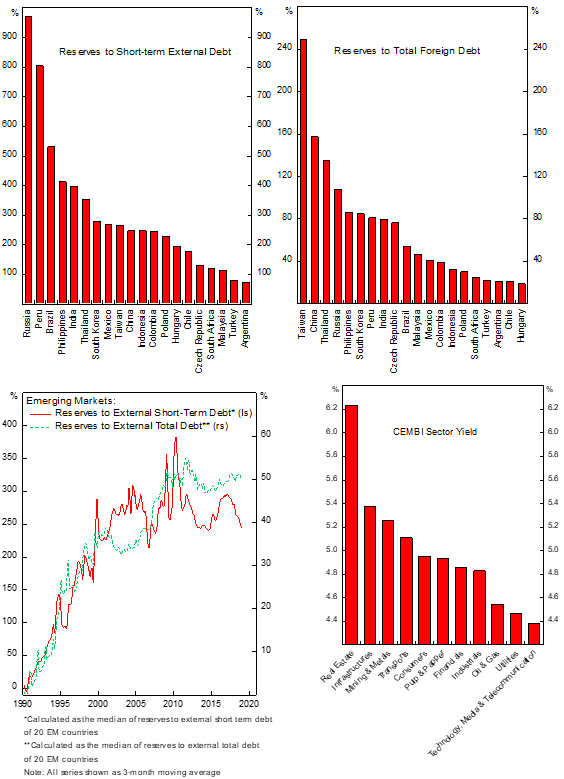

- Various risk metrics show that majority of EM countries external risk profile has decreased significantly in the past decades as risky countries built a buffer against sudden pullback in capital flow. Issuance of local currency debt is outpacing its hard currency counterparts (check) and the capital in the banking sector is much higher than it was during previous crises periods.

- Many EM currencies are cheap, according to our fair value model, making EM countries local currency bonds attractive. Historically local currency bonds outperform its dollar counterparts during period of Fed easing and dollar weakness.