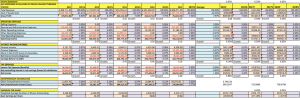

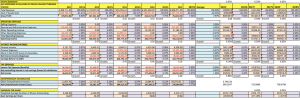

Metrodata Electronics is a stock that I have observed for over 3 years now. It’s valuation is cheap and provides a considerable upside potential from the current price. The business itself doesn’t grow very fast, but is stable. From my valuation incorporating higher risk-free rate (due to the rising government bond yield), results in target price of Rp 1680/share. With last Friday closing price at Rp 660/share, there is 155% upside potential.

Download the excel file containing the full valuation:

mtdl-metrodata-update-1h16

Published by Journeyman

A global macro strategist and equity portfolio manager with over seven years experience in the financial market, the author began his career as an equity analyst before transitioning to macro research, which led to his current job as quantitative equity portfolio manager at a bank. He read voraciously, spending most of his weekend reading The Economist magazine and books on finance, history, and psychology. The author also works part-time for Getty Images. To date, he has over 1200 pictures over 40 countries being marketed through the company.

View more posts