Nearly fifteen years ago, Marc Andreessen – the cofounder of Andreessen Horowitz and Netscape – wrote an op-ed in the Wall Street Journal on Why Software is Eating the World. He highlighted at that time valuation for many technology companies was only at par with the broader stock market despite having much higher profitability and stronger market position. Of course, this has changed a lot in the past decade with valuation for leading tech companies today often double or triple the median stock in the U.S. equity benchmark. He also highlighted that software and the online services bult on top of it are disrupting various industries from selling books (Amazon), watching movies (Netflix), listening to music (Spotify), recruiting (LinkedIn), to marketing (Google).

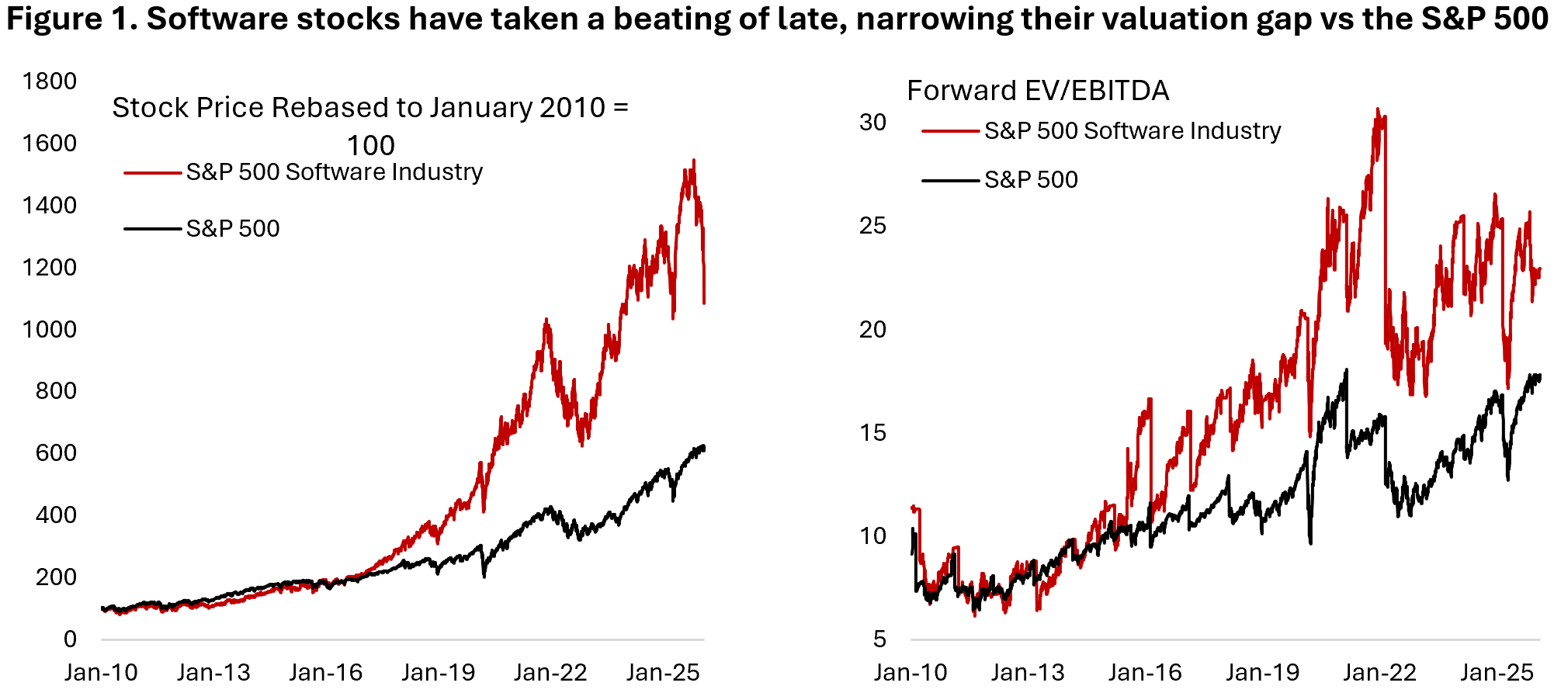

Six years later, in 2017, Jensen Huang – the CEO of Nvidia – said in his interview with MIT Technology Review, “software is eating the world, but AI is going to eat software“. Note that this is years before the word AI enters mainstream consciousness. In the interview, he highlighted the potential for machine learning to improve autonomous driving capability and diagnostic in the healthcare industry. Eight years later, his forecast turned out to be quite accurate. But it is only in the past three months that investors start to worry that perhaps enterprise software companies could become increasingly less relevant with the advancement of vibe coding – a software development approach that allows users with limited programming experience to build software with the help of AI tools. Following the peak in last September, a basket of software names (IGV ETF) has fallen roughly 30% even as the broader U.S. equity market continued to rise. S&P 500 Software subsector is now trading at 23.0x forward EV/EBITDA vs 17.8x for the S&P 500, narrowing the valuation gap from 78% in January 2024 to 29% currently (Figure 1).

The introduction and recent upgrade of Claude co-working tools have accelerated investors’ fear, with many now expecting businesses will opt to develop their own software rather than relying on third-party vendors soon. Claude Cowork, for instance, can help lawyers perform several clerical tasks such as tracking compliance and reviewing legal documents – potentially circumventing the need for specialized legal software. The stock price of Thomson Reuters has fallen 58% from the peak in July 2025, despite the company reaffirming its targets for 2026 and the business fundamentally continues to grow at a healthy rate. Similar logic applies to software companies servicing the financial industry, human resources, design and creative sector, among others.

Although AI tools may help businesses to develop their own software internally for simpler needs, software vendors often integrate multiple capabilities into one centralized application or platform that make it easier for users to operate. Many also provide proprietary data that may be inaccessible to AI co-working tools. In addition, majority of large software companies have also developed their own agentic AI capabilities integrated into their platform to compete against general-purpose AI tools. These are some reasons why we doubt enterprise clients will start mass canceling their software and data subscription in the near term and migrate to an internally built tool.

While investors were pricing in the most optimistic outcome for software companies back in 2021 – with EV/EBITDA multiple averaging 30 times at one point – the sentiment is pointing to the other direction today. We don’t know how this will play out, but arguably some of the currently oversold software companies will be able to maintain their market share and business model by integrating AI into their processes.

Investment Implications

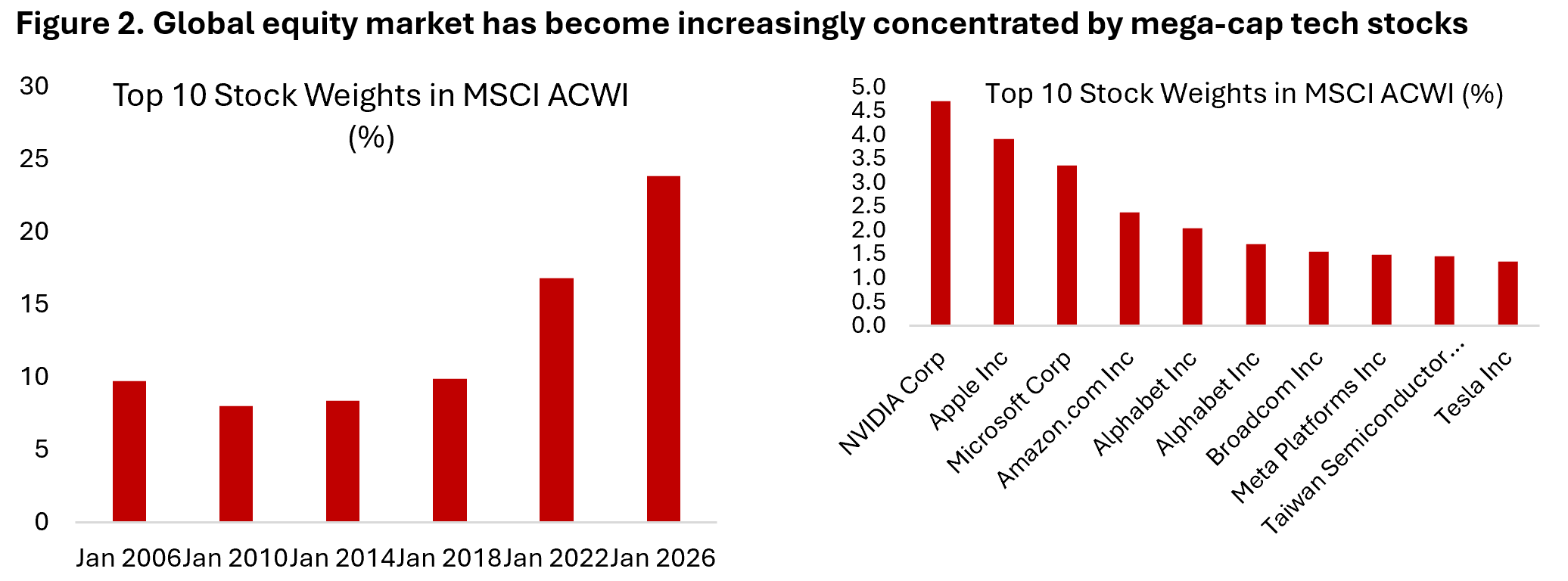

Given the tremendous growth of software stocks’ market cap and weights in the equity benchmark, the recent sharp sell-off has translated into a higher portfolio volatility for most investors. Although the U.S. and global equity markets are less than 5% below all-time high as of the time of writing, investors with concentrated equity positions in growth/momentum/software/tech complex will have seen materially higher volatility relative to a more diversified investor (Figure 2).

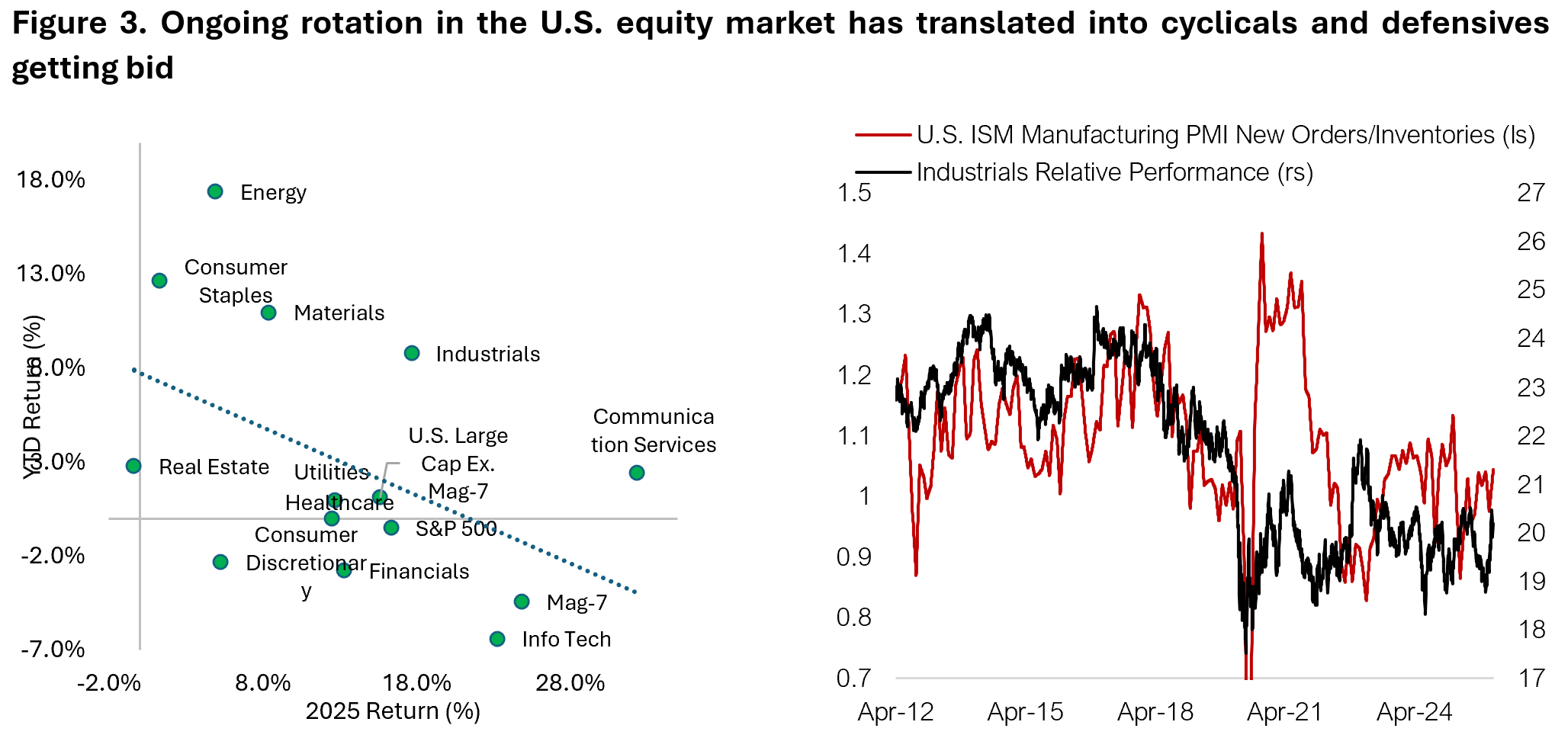

There is also the psychological aspect of it. Following three years of double-digit return in U.S. equities, many investors are expecting the asset class to continue deliver such high return this year. Combined with long period of low volatility in the market, many investors have become complacent. Investor sentiment was very bullish at the beginning of this year and has only moderated to around average level currently (Figure 3).

Underneath the surface, however, we saw healthy rotation in the U.S. equity market from growth into parts of cyclicals and defensives, which have delivered strong returns so far this year (Figure 3). For two quarters now we have talked about the potential for acceleration in cyclical activity in the U.S. and globally. That is now playing out with old-economy industrial and material sector outperforming the benchmark and January’s ISM manufacturing PMI showing sharp pickup in new orders. Within equities, we continue to diversify exposure towards cyclical industries that could benefit from upswing in the business cycle.

From an asset allocation perspective, it is important to choose your diversifiers carefully. Commodity exposure, including gold, proved to be a great diversifier over the past two years amid favourable supply/demand backdrop where governments are increasing their stockpile of major commodities while central banks increase their allocation to gold.

On the other hand, many investors thought foraying into cryptocurrencies was a great idea as a hedge against inflation and fiat currency debasement. Recent experience proved that Bitcoin return is correlated to neither inflation nor the U.S. dollar. Despite the heightened fear of dollar debasement, Bitcoin price fell 50% from the peak last October.

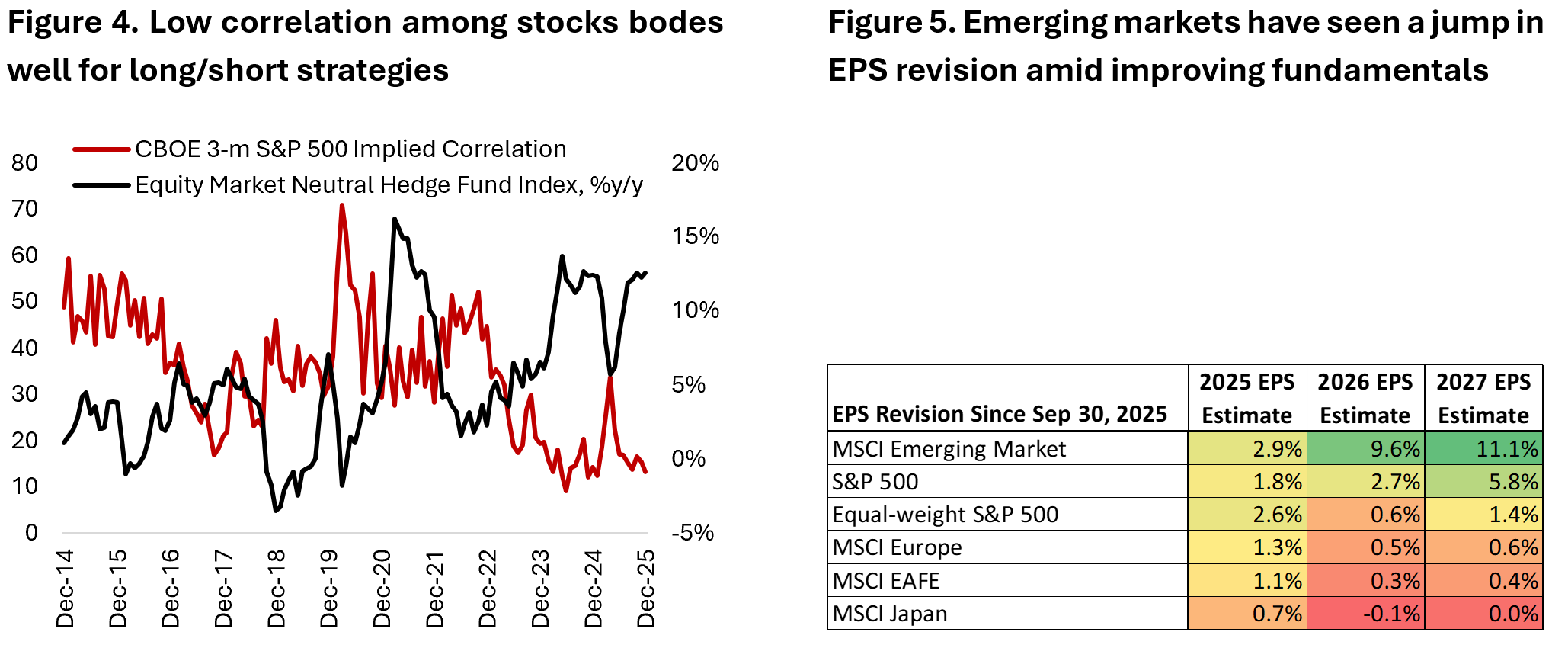

Amidst the backdrop of elevated concentration risk and expensive equity market, investors would also do well diversifying into hedge fund exposure that offers low correlation to public equity and fixed income. Rising dispersion in the equity market, which is the case today, tends to bode well for the return of long/short equity managers and other relative value strategies (Figure 4).

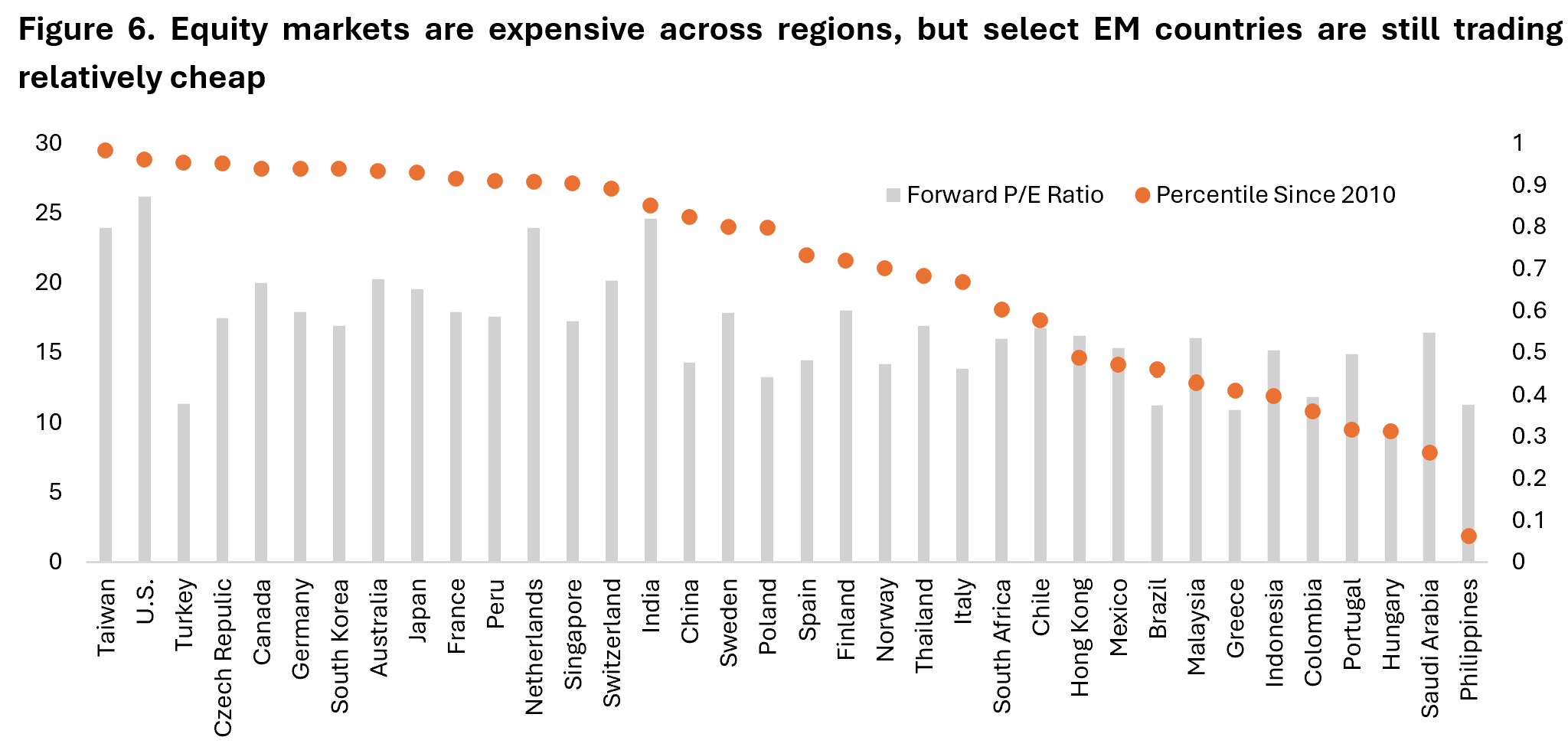

Lastly, emerging markets and international stocks tend to also benefit more from an improving global growth outlook and weaker dollar. Both EM and international equities have the potential to continue its outperformance relative to U.S. stocks – following outsized gains last year. Since the last quarter, earnings revision for EM equities has been revised sharply higher (Figure 5) while select EM countries still offer compelling valuation, with caveat. When it comes to investing in emerging markets, most investors would do well to approach it with an active mindset and deeper-than-usual due diligence process.

Copyright © 2026, Putamen Capital. All rights reserved.

The information, recommendations, analysis and research materials presented in this document are provided for information purposes only and should not be considered or used as an offer or solicitation to sell or buy financial securities or other financial instruments or products, nor to constitute any advice or recommendation with respect to such securities, financial instruments or products. The text, images and other materials contained or displayed on any Putamen Capital products, services, reports, emails or website are proprietary to Putamen Capital and should not be circulated without the expressed authorization of Putamen Capital. Any use of graphs, text or other material from this report by the recipient must acknowledge Putamen Capital as the source and requires advance authorization. Putamen Capital relies on a variety of data providers for economic and financial market information. The data used in this publication may have been obtained from a variety of sources including Bloomberg, Macrobond, CEIC, Choice, MSCI, BofA Merrill Lynch and JP Morgan. The data used, or referred to, in this report are judged to be reliable, but Putamen Capital cannot be held responsible for the accuracy of data used herein.