It is only one month to go before 2023 official ended and the U.S. economy is turned out to be much more resilient than we previously thought at the beginning of the year. Consumer spending continues to be significantly above pre-pandemic trend, even after adjusting for inflation, and both unemployment rate and jobless claims remain at a depressed level. The good news does not stop there. Inflation, investor’s main worry over the past two years, is also declining from as high as 9.1% y/y in mid-2022 to 3.2% currently. This supports the idea that the Fed has successfully navigated the U.S. economy through the turbulent weather and it is a blue sky ahead. Recession in the U.S. is no longer a consensus call, despite a relapse in manufacturing PMI survey and depressed consumer sentiment. Stock-to-bond ratio continues its upward trend post pandemic, defying the gravity of downturn in global business cycle.

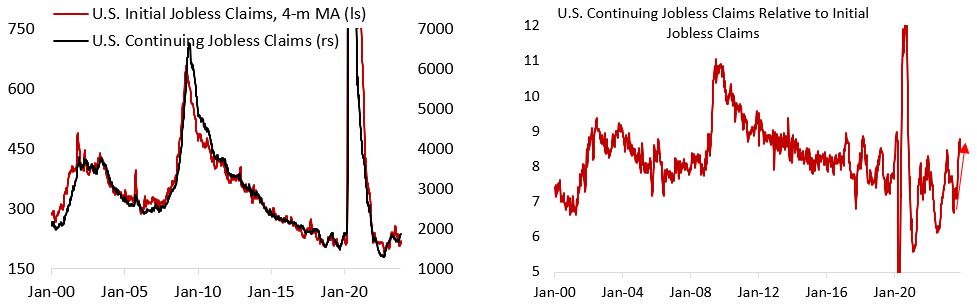

In hindsight, we underestimated the positive growth impulse this year coming from rising government fiscal deficit and the size of households’ excess savings, which support U.S. growth for a bit longer than historically the case. However, going into the new year, global growth forecast is expected to decelerate to below trend next year, while the U.S. labour market is showing more definitive signs of easing. Despite initial jobless claims still hovering near record-low level, the ratio of continuing to initial claims suggest it is taking longer for unemployed individual to find a new job.

On the positive note, S&P 500 earnings growth is turning positive in Q3/23 for the first time in twelve months and financial conditions is loosening again as yields drop, the dollar fell, and oil price is in a bear market. These all should support corporate margin and household spending. The macro environment is mixed at best, and we continue to see elevated probability of recession. From an asset allocation perspective, we think 2024 could be the year we see a reversal of stock-to-bond ratio, given that much of the lagged impact from monetary policy tightening is still ahead of us and fiscal impulse likely turned into a drag this quarter. In short, we think recession is only delayed, not cancelled.

Despite the S&P 500 nearing its record-high level, the average U.S. firms are not doing particularly well. NFIB small business surveys show that small businesses are reporting sales and earnings decline comparable to the trough in previous cycles and only surpassed by the global financial crisis and 1981 recession. The jump in cyclical sector performance relative to defensives has also diverged from the decline in oil prices – a proxy of global growth. The bottom line is that global growth will likely continue to decelerate in 2024 and the U.S. economy is nowhere close to a start of a new business cycle.

Managing investments is the art of managing risk, not return, as investor could not reliably predict ex-ante returns but could always control the amount of risk they are taking. This is why a portfolio manager need to balance the need of being an optimist while preparing for the worst. To be clear, we have been and remain cautious on risk assets and believe the recent rate-driven rally is stretched considering U.S. stocks’ valuation back to very rich territory and next year’s consensus earnings growth being significantly above nominal GDP growth. Below we listed risks that are on top of our mind. The scenario below is not our base case view, and we and we are assigning less than 50% probability for each of these cases. For instance, although we are expecting the U.S. labour market to ease at a faster rate and inflation to continue to slide towards 2% by the end of 2024, a spike up or down in unemployment rate and inflation would surprise us. Below are our top-of-mind risks for the coming year.

- Unemployment rate rises above 5%

The share of small and medium enterprises reporting actual revenues and earnings decline is currently on par with the levels seen during previous business cycle trough, including in the Global Financial Crisis and post-2000 tech bubble. Although SMEs account for a relatively small share of U.S. stock market capitalization, they employed a disproportionately higher share of U.S. workers. Without access to the capital market, SMEs also rely greatly on bank loans for financing, which means the current tightening in lending standards is hurting companies who could afford it the least. This is also reflected in the underperformance of Russell 2000 small cap index relative to its S&P 500 counterpart. NFIB small business survey shows that SMEs are already reducing their hiring plans, which is consistent with a 5% unemployment rate in the coming two quarters.

Hedge Trade: Long U.S government bonds and underweight discretionary stocks. Buy a curve steepener of U.S. government bonds.

- Oil spike above $90. Regional conflict in EMEA: Ukraine-Russia, Israel-Hamas, Iran nuclear capability

Russian invasion of Ukraine, Israel-Hamas war, supply discipline among OPEC+ and U.S. shale producers are all fundamental forces that should support oil prices trading above $85/bbl mark. Yet oil prices have fallen over 20% from its high amid limited impact from geopolitical uncertainty and concerns of a weak global economy. Canada, U.K., and several countries in Europe are likely already in a technical recession, based on preliminary reading of Q3/23 GDP estimate and economic surveys. The risk is that Iran, which currently produces 3.2 million barrel/day or roughly 3% of global production, could face tightening sanctions amid the tense situation in the Middle East and Russia. It is difficult to estimate the exact magnitude of the impact of Iranian oil export curb, but a supply disruption amounting to half of Iranian production could translate to anywhere between 20-50% higher global oil price.

Hedge Trade: Long oil futures, overweight traditional energy and commodity exposure in the portfolio.

- Jump in defaults of floating rate debt

The massive underperformance and derating of the real estate sector, and front-page news related to rising default rate of office buildings highlight the problem surrounding property sector in an environment of higher rate. Although cap rate for all equity REITs has been rising, they are only back to pre-pandemic average and does not look attractive after adjusting for the increase in government bond yield. The deterioration in interest coverage ratio and higher cap rate suggests lower commercial real estate loan growth ahead, which further worsen their liquidity profile. Data from Moody’s Analytics show that so far this year among CMBS office loans, only a third have been paid off. Another third had their terms modified or extended and fully a third went into default. According to Moody’s:

“For banks, the reckoning may come next year. Many of them have a much larger slice of loans coming due in 2024 than this year. In Bank of America Corp.’s case, 36% of office loans are due to mature next year, up from 22% in the final three quarters of 2023. The outcome may not be as bad as in the CMBS market. That’s partly because the risk of loans in CMBS is higher than on bank balance sheets, as reflected in divergent delinquency trends. Office CMBS delinquencies are running at 5.75% in October, according to Trepp, and 4.63% overall, while bank delinquencies remain close to cyclical lows at around 1%. It’s also because banks have more discretion to adjust terms than do the special servicers who manage CMBS.”

The good news is that yields are starting to come down, which should ease the interest burden faced by businesses with high leverage ratio.

Hedge Trade: Cyclically underweight CRE exposure and regional banks in an equity portfolio.

- Deflationary forces gaining ground

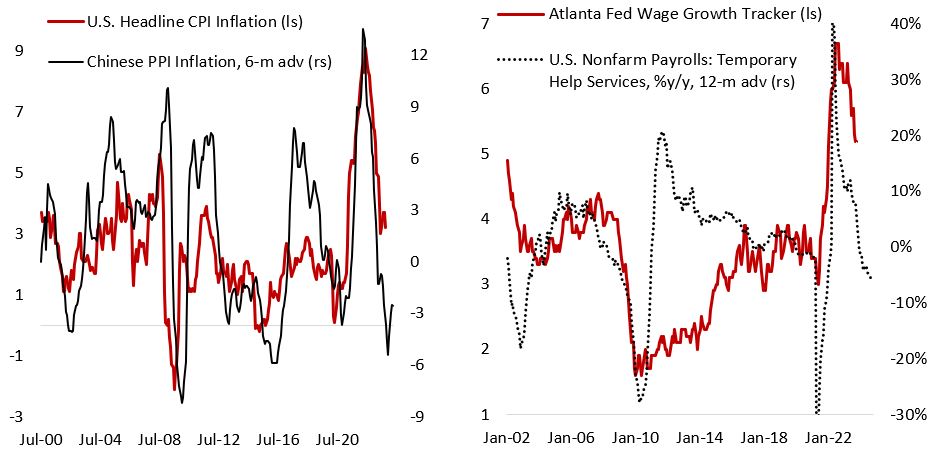

Inflation has come down quicker-than-expected over the past couple months following a hiccup earlier in the year, falling from as high as 9.1% y/y in mid-2022 to 3.2% in October 2023. Supply-chain has completely normalized, agricultural and energy, including oil, prices are falling, and wage growth is declining – all of which should be headwinds for goods and services inflation in the coming months. The disinflation in housing cost, a large share of CPI basket, is in its early stage and should translate to lower m/m change in 2024. More importantly, weak Chinese economy is translating to cheaper goods cost for the rest of the world. These factors point to a continued disinflation for U.S. headline CPI. Given that the bulk of the lagged impact of Fed’s monetary tightening is still on the pipeline and U.S. GDP growth is expected to be only 1% next year, it is not impossible for inflation to undershoot Fed’s 2% target.

Hedge Trade: Long U.S. government bonds and overweight companies with stronger pricing power and less cyclical exposure (defensive stocks).

- Bank of Japan’s quicker exit from YCC and negative interest rate policy

Despite inflation rising to the high last seen three decades ago, the Bank of Japan remain steadfast in maintaining negative policy rate. Although BoJ slightly loosen the cap on 10-year yield to 1% as a reference level only, monetary policy is significantly loose especially when compared to the rest of world. The Japanese Yen has also been depreciating on the back of rising interest rate differential relative to other global central banks. The risk of abrupt exit from BoJ’s negative rate policy could spur repatriation of capital into Japanese market, unwinding of carry trades, and tightening of global financial condition. In addition, given the highly leveraged public sector of over 250% of GDP, a rise in government borrowing rate could raise the question of its fiscal sustainability.

Hedge Trade: Short EURJPY.

- Extreme right government in Europe and increasingly dysfunctional U.S. government going into election year

The popularity of far-right parties in Europe continues to march higher as the continent is battling with stagnating quality of life under the incumbent governments, influx of migrants amid Ukraine war and surge in asylum seekers, high inflation, and unpopular climate policies. Netherlands’s far right party is winning significantly more seats in the parliament, while in Germany AfD is currently polling between 19% and 23% nationally, higher than the Social Democrats (SDP), the Greens, and the pro-business Free Democrats (FDP), who currently make up Germany’s coalition government. The rising trend of the far right is unlikely to change anytime soon given the voters’ backlash on the way climate reforms are being implemented, including the ban on the registration of cars with internal combustion engines in the EU and the installation of gas and oil boilers in new buildings – which entails high costs and the excessively burdening household budgets.

Meanwhile, across the Atlantic President Biden approval rating is falling to below his predecessor Donald Trump, which currently lead the poll for 2024 presidential election. A far-right government in Europe will likely raise the question of each sovereign fiscal sustainability and increase the volatility of respective country’s assets. In the long run, a more protectionist agenda could hinder productivity growth and raise prices for consumers.

Hedge Trade: Buy gold and underweight European government bonds within global fixed income portfolio.

- China’s failure to stimulate consumer spending and growth

It almost always takes a crisis for policymakers to do the right thing, which is also the case for Chinese policymakers this year amid a weaker-than-expected economic recovery and property sector crisis. Following the three red lines policy (caps on debt-to-cash, debt-to-assets and debt-to-equity ratios of property developers) unveiled in August 2020, Chinese developers have undergone through a liquidity and solvency crisis that translate to multi-year double-digit decline in floor space started. Projects are not completed despite millions of households already paying down payment for the properties, which depress consumer confidence. In addition, both credit and fiscal impulse turned negative earlier this year – a significant drag for GDP growth.

The good news is that policymakers are now acknowledging the problems and have been increasing policy support, including the widening of fiscal deficit to 3.8% of GDP from 3.0% previously and encouraging banks to provide adequate financing for developers included in the whitelist. However, the supports announced so far are inadequate to solve local government financing issues and weak consumer spending. A larger fiscal package is needed to lift Chinese households’ willingness to spend.

Hedge Trade: Underweight Europe and China within equity portfolio, long U.S. dollar against EM currency basket.

Copyright © 2023, Putamen Capital. All rights reserved.

The information, recommendations, analysis and research materials presented in this document are provided for information purposes only and should not be considered or used as an offer or solicitation to sell or buy financial securities or other financial instruments or products, nor to constitute any advice or recommendation with respect to such securities, financial instruments or products. The text, images and other materials contained or displayed on any Putamen Capital products, services, reports, emails or website are proprietary to Putamen Capital and should not be circulated without the expressed authorization of Putamen Capital. Any use of graphs, text or other material from this report by the recipient must acknowledge Putamen Capital as the source and requires advance authorization. Putamen Capital relies on a variety of data providers for economic and financial market information. The data used in this publication may have been obtained from a variety of sources including Bloomberg, Macrobond, CEIC, Choice, MSCI, BofA Merrill Lynch and JP Morgan. The data used, or referred to, in this report are judged to be reliable, but Putamen Capital cannot be held responsible for the accuracy of data used herein.